Sue Mitchell

February 1, 2018

UBS cut profit forecasts for Coles after a supplier survey found its performance deteriorated almost across the board to levels not seen since 2009.

Coles has “lost its way” and needs to shift strategy after falling further behind Woolworths in areas such as in-store execution, strategy and morale, according to suppliers.

Investment bank UBS has cut its 2018 and 2019 profit forecasts for Coles after a survey of 45 suppliers found Coles’ performance deteriorated almost across the board in the December-half to levels not seen since 2009.

“Based on supplier feedback, Coles has lost its way,” said UBS’ retail team, led by analyst Ben Gilbert.

“Staff calibre and morale are near all-time survey lows, customer-facing metrics [such as on-shelf availability and promotions] are deteriorating and its marketing strategy is not as effective,” the UBS report said.

“Coles’ strategy has become reactionary, with an over-reliance on price-based promotions and not enough focus on other value measures [quality, community, family], albeit this is changing,” UBS said.

“We believe Coles needs to shift its strategy, which will likely require further incremental [operating expenditure and capital expenditure] investment,” it said.

UBS cut its profit forecast for Coles by 3 per cent in 2018 and 6 per cent in 2019 and believes that, contrary to management guidance, earnings are unlikely to recover in the June-half.

December-half EBIT is expected to fall 18 per cent and June-half EBIT by 3 per cent.

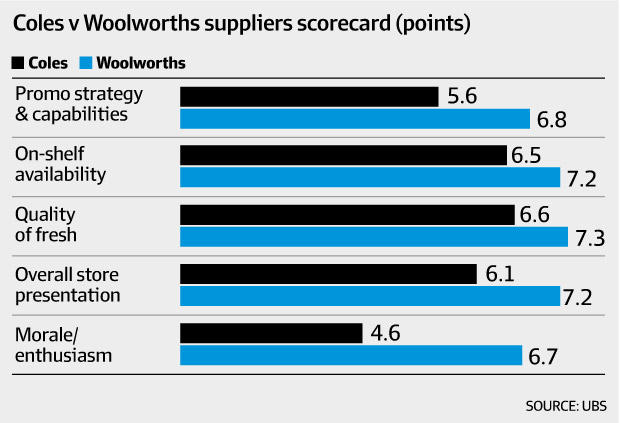

The survey of 45 suppliers is conducted twice a year and rates Coles and Woolworths on 26 issues, including in-store execution, on-shelf availability, promotions, price perceptions, quality of fresh, store presentation and instore theatre, strategy and tactics, culture, staff morale, and marketing.

The survey has historically had a close correlation with Coles’ and Woolworths’ same-store sales and is regarded by fund managers as a key leading indicator for future performance.

Coles’ overall score fell 0.6 points to 5.5 (out of 10), the lowest since August 2009, and its ratings went backwards on 25 (the score for value was flat) of the 26 issues, with the worst decline in morale and calibre of senior management, promotional effectiveness and category management and planning.

Woolworths’ overall score also went backwards in the December-half, slipping 0.3 points to 6.4, but Woolworths widened its lead over Coles in 24 of the 26 issues and improved in areas such as out-of-stocks, the quality of fresh food and store presentation, reflecting the focus of executive Brad Banducci and new supermarkets managing director Claire Peters.

Woolworths had opportunities to improve, UBS said, particularly in private label and use of data, where scores went backwards even though Woolworths cut private label prices last year and gave suppliers free access to data through its Supplier Connect portal.

Coles’ scores are now below those for Woolworths in the dark days of 2016, when Woolworths lost sales and market share after raising prices to protect margins.

“The decline in scores is worrying and suggests Coles’ investment in staff, price and marketing over 2017 has had little impact, in the view of suppliers,” UBS said.

“We believe the key question facing Coles now is does Coles need to shift its strategy or step up investment.”

UBS believes Coles needs to do both, even though Coles tripled its investment in prices, service and stores in the second half of 2017 to an incremental $195 million and managing director John Durkan has indicated similar levels of investment in the first half of 2018.

Coles also plans to step up the number of store refurbishments from 30 to 50 in 2018 to keep pace with Woolworths, which plans to refurbish 80 stores.

Mr Gilbert said Coles’ prices are not the issue, as suppliers believe prices at both chains are on par after Woolworths’ $1 billion investment over the past 18 months.

Rather, UBS believes Coles is too focused on price and not focused enough on in-store theatre, events and community.

Coles appears to be attempting to rectify some of these oversights, relaunching its Sports for Schools program in 2018 and signing a three-year partnership (including the supply of free bananas) with Little Athletics in September.

Coles declined to comment on the UBS report, citing the release of first-half results on February 21.

Coles’ same-store food sales rose 0.3 per cent in the September quarter (the lowest rate of growth since it was bought by Wesfarmers in 2007), compared with 4.9 per cent growth at Woolworths supermarkets.

UBS believes Coles’ same-store (food and liquor) sales grew 0.6 per cent in the December quarter and Woolworths’ same-store supermarket sales grew 4 per cent, outpacing Coles for the fifth consecutive quarter.

“Woolworths … won the key Christmas period,” UBS said. “This in our view is significant given Christmas is a key barometer for the rest of the year … with the ‘winner’ likely to be best placed heading into 2018.”

UBS retained its buy rating on Woolworths and neutral rating on Wesfarmers. Coes accounts for about 30 per cent of Wesfarmers earnings.

“We believe the market has not fully priced in deteriorating trends for Coles and the subdued outlook,” UBS said.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.