Angela Macdonald-Smith

July 12, 2018

AFR

Viva Energy CEO Scott Wyatt ahead of the listing of the fuels supplier on Friday. Peter Braig

Viva Energy chief executive Scott Wyatt has declared the fuels supplier will be on the lookout for more acquisitions as it embarks on life as a $4.9 billion publicly traded company.

Viva, which will list shares on the Australian Securities Exchange on Friday after raising $2.65 billion in an initial share offer, will have a balance sheet that will allow for more acquisitions as well as for targeted expansion in fuels and convenience retailing, Mr Wyatt said on Thursday.

“We’ve got some really exciting programs ahead of us and I’m looking forward to getting on with it,” he said.

“Our history says our growth strategies are going to be a mix of acquisition and organic growth.”

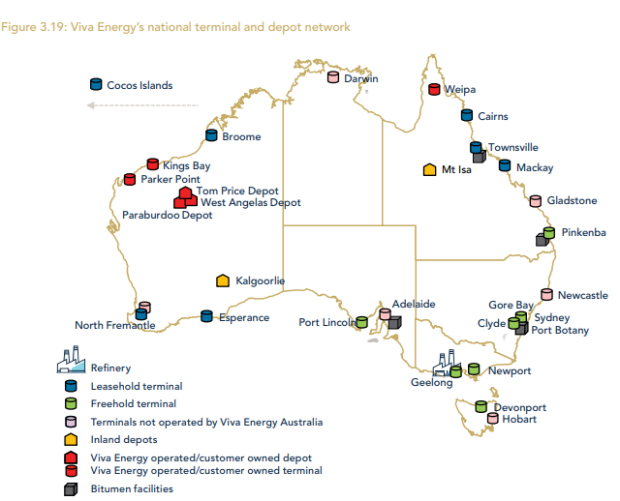

Viva has a network of fuel depots and terminals as well as its refinery and petrol station network. Viva Energy

Viva acquired 50 per cent of the Liberty Oil independent fuel retailer in 2015 and Shell Australia’s aviation fuels business last year, and has also struck a $15 million deal to acquire half of fuels retailer Westside Petroleum, subject to regulatory approval. In total it has invested more than $1 billion in expansions and upgrades for the business, the former Shell Australia’s Geelong refinery and petrol station network, since buying it for $2.9 billion in 2014.

Viva’s owners, led by global energy commodities trader Vitol, sold 55 per cent of the Melbourne-based company in the IPO, priced right at the bottom of the flagged range of $2.50-$2.65 a share.

The pricing was been welcomed by some investors keen to pick up a stake in what they see as a solid investment prospect.

Mr Wyatt said the price range had been “pretty tight” and the result was a “good balance” for the owners, who are seeking a return from their investment, and the new shareholders.

“The outcome reflects where the market is at for our company, but also reflects our shareholders’ desire to have a really high-quality investor base going forward – which I think we’ve achieved – and allows them to maintain a strategic position in the business going forward as well.”

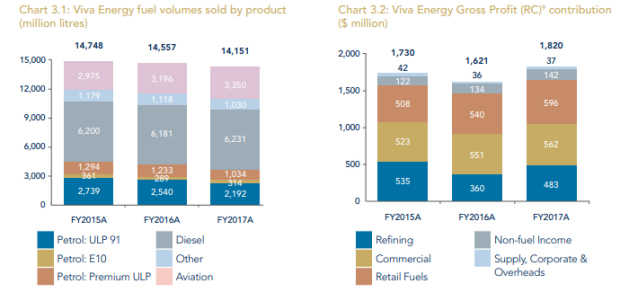

Viva’s sales are split between fuels. Viva Energy

The listing of the former Shell Australia refining and petrol retailing business will add a second listed fuels supplier to join $8.1 billion Caltex Australia, with the looming prospect of a third if Woolworths decides to float its petrol business after a sale to BP fell through.

Mr Wyatt said he was unconcerned about the potential for more competition for investor dollars, noting Viva’s strong partnerships with high-profile brands such as Shell, whose logo it uses at its service stations, and alliance partner Coles Express. Retail investors bought 22 per cent of the new shares.

“The exciting thing about the downstream industry in Australia is that it continually changes, and that keeps it interesting and continues to throw up opportunities for us,” he said.

“It’s always been very competitive business and our focus is on what we’re doing and our strategies are designed to ensure we are successful in that competitive environment.”

A $3.4 million cash bonus and options for Mr Wyatt that will be triggered by the listing has raised eyebrows in the market and is a legacy deal struck with the Vitol-led investor group.

Mr Wyatt wanted to focus on the remuneration structure going forward, which he said is “very clearly linked” to shareholders’ interests.

The short-term incentive program is based around achieving earnings forecasts for the next two years, which Mr Wyatt said would focus him and his executive team on delivering.

The long-term incentives use a three-year period, with 50 per cent based on relative total shareholder returns to peers in the ASX 100, with the rest split equally between delivering on targets for free cash flow, which goes to paying dividends, and on return on capital employed.

“It’s a nice balanced mix of performance measures that are hopefully aligned with what investors are looking for,” Mr Wyatt said.

The float leaves Viva, which spun out its retail sites in a real estate investment trust in 2016, with just $78 million of net debt.

“They’ve left us with a balance sheet that has very little net debt on it and continued ownership in Viva REIT of 38 per cent, so a significant stake in that entity as well, so we’ve been really set up very well for the future and for growth,” Mr Wyatt said.

The shares are due to start trading on the ASX at midday Friday.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.