Tobacco excise revenue has shrunk to a nine-year low as smokers turn to the black market for cheaper cigarettes, prompting calls for the federal government to boost enforcement to plug the growing shortfall.

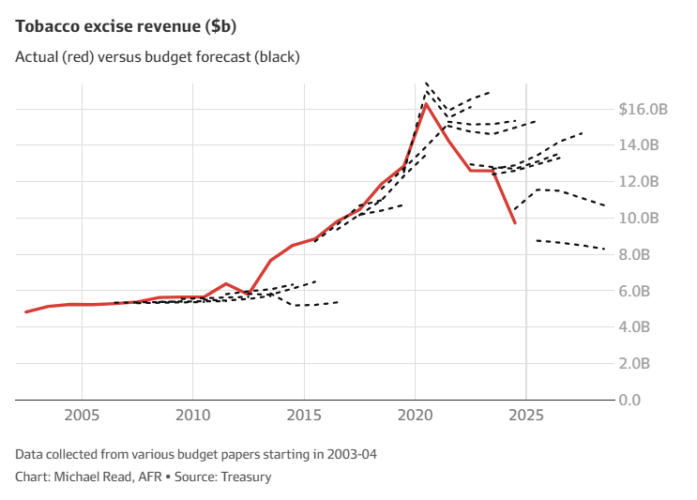

The federal government collected just $9.7 billion from the tobacco excise last financial year, according to Treasury, a 40 per cent fall from the record $16.3 billion haul in 2019-20 and the lowest take since 2014-15.

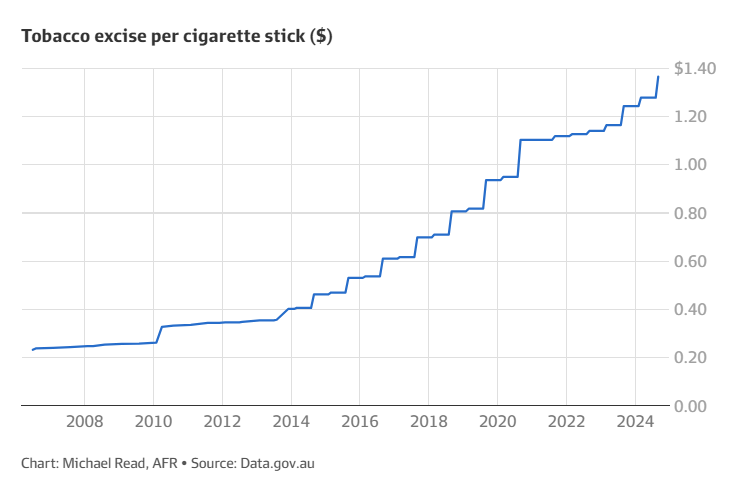

Successive Labor and Coalition governments have collectively increased the tobacco excise by 282 per cent since 2013, pushing the cost of a 25-pack of cigarettes to about $50 dollars – $34 of which goes to the government.

Economists say the increases have become counterproductive and pushed consumers to the black market, rather than deterring them from smoking.

The growth in illegal sales has also come at the expense of tax revenue.

Treasury has consistently overestimated how much tobacco tax the federal government will receive since 2019, and the mid-year budget update in December revealed yet another downgrade in projected collections.

Treasury expects to collect $10.7 billion less tobacco revenue over the next four years than it forecast in May, with excise revenue projected to fall to a decade low of $8.8 billion in 2024-25.

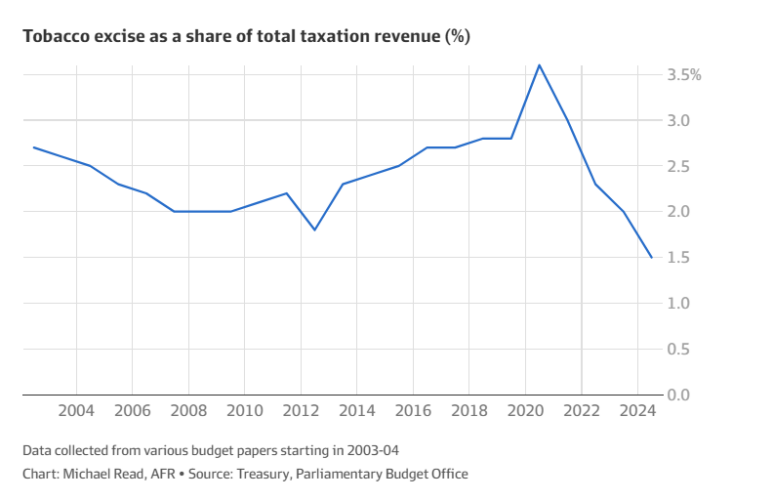

Tobacco taxes made up just 1.5 per cent of total revenue in 2023-24, which was the lowest on record, according to analysis of two decades of budgets by The Australian Financial Review.

The combination of rising tobacco excises and public health campaigns has caused the proportion of adults who are daily smokers to halve from 22.4 per cent in 2001 to 10.6 per cent in 2022, according to the Australian Bureau of Statistics.

Angela Jackson, lead economist at Impact Economics and Policy, said the decline in revenue was due to both fewer people smoking and existing smokers turning to the growing market for illegally imported, tax-free tobacco.

“The question is, are we at a point now where further [excise] increases aren’t necessarily leading to people smoking less, but pushing them to purchase cigarettes on the black market,” Dr Jackson said.

Veteran budget watcher Chris Richardson said the magnitude of the excise decline since 2019-20 was so large that it could not simply be because people had quit smoking.

The Australian Taxation Office, which works alongside the Australian Border Force on enforcement, said the illicit tobacco market was increasing despite the decline in smoking rates.

The Tax Office estimates a record 18 per cent of all tobacco for sale in 2022-23 was illicit, and would have earned the federal government an extra $2.7 billion if it was instead sold legally.

Vapes, e-cigarettes and other products containing nicotine are not subject to excise duty.

The lure of handsome profits has fuelled a growing industry of corner stores selling illegal tobacco and a commensurate increase in firebombings, as gangs battle over control of the fast-growing market.

The surge in crime has been most acute in Melbourne, with more than 120 arson attacks since March 2023 linked to a turf war over illicit tobacco.

The Victorian government established a police taskforce in October 2023 to get the situation under control.

It has so far arrested 68 people, seized more than $2 million in cash and several tonnes of illicit tobacco, according to Victoria police.

Tax up, enforcement down

Mr Richardson, who previously served on the ATO’s tax gap expert panel, said the federal government had pushed the tobacco excise too hard without an equivalent increase in enforcement.

“You can consistently raise taxes and earn more, even from a declining product, but you reach a point at which the tax starts to be ineffective,” he said.

The best approach from here was to enforce the current rate of tobacco excise rather than lowering the tax to try and lure people back into the legal market, Mr Richardson said.

“But one way or another, you can’t tax at really high levels and enforce at really low levels.

That gap is entirely unsustainable and it’s producing all sorts of broken outcomes, including the financing of crime.”

The Coalition has promised to commit $250 million to combat illegal tobacco, setting up a taskforce to be led by the Australian Federal Police and the Australian Border Force.

Shadow treasurer Angus Taylor said the commitment was more funding than Labor had put forward to crack down on the black market for illegal tobacco and vaping products.

“It is clear that we need a tough cop on the beat to respond to the lack of real action from the Albanese government, which has allowed the illicit vaping and tobacco black market to thrive,” he said.

Treasurer Jim Chalmers did not respond before deadline.

He has previously ruled out cutting the tobacco excise to stem the exodus to the black market, saying that would require the government to raise other taxes.

Coalition MPs Llew O’Brien and Warren Entsch broke ranks in October, telling the ABC there needed to be a discussion about lowering tobacco taxes to counter the rise in the black market.

Significant excise rises by successive federal governments mean the tobacco excise per cigarette stick has increased to $1.37 from 36¢ in August 2013 – a 282 per cent increase.

Wages, by contrast, have increased by just 31 per cent over that period.

The Rudd government announced in August 2013 that the federal government would increase the tobacco excise by 12.5 per cent per year for four years on top of the ordinary indexation that occurs.

The policy was framed as a health measure, but had the added benefit for the government of raising a projected $5.3 billion over four years.

While the final hike was meant to take place in July 2016, then treasurer Scott Morrison announced in May 2016 the jumbo excise rises would be extended for another four years to 2020, raising an extra $4.7 billion.

After a couple of years of reprieve, Dr Chalmers said in May 2023 the federal government would increase excises by a further 5 per cent on top of the normal indexation for three years.

Dr Jackson said there was no doubt that the combination of higher prices and plain packaging laws had contributed to the steady decline in the share of Australians smoking.

“But it is, it seems, that consumers are now willing to purchase cigarettes on the black market, effectively breaking the law… rather than necessarily quitting smoking,” Dr Jackson said.

View article source here.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.