Want to see how a leading payments company – Alipay – operates and the possible benefits for your business? Join the AACS Study Tour to China to visit the amazing Alibaba company where you will learn about payment and other opportunities and trends.

Roy Morgan

June 08 2018

It’s Official: Most Australians now use Digital Payment Solutions. It wasn’t that long ago we were talking about moving to a cashless society, now we may be looking at a cardless society too.

New research on Digital Payments Solutions unveils that over 14.5 million Australians aged 14+ (71.7%) use Digital Payment Solutions in a 12 month period.

Digital Payments Landscape

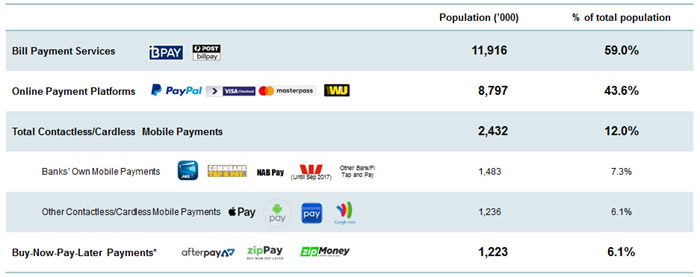

There is a plethora of Digital Payment Solutions in the market and Roy Morgan has identified four key categories: Bill Payment Services, Online Payment Platforms, Contactless/Cardless Mobile Payments, and Buy-Now-Pay-Later Payments.

Digital Payment Solutions used by Australians in Last 12 Months

Source: Roy Morgan Single Source (Australia) 12 months to March 2018, n = 50,014.

Base: Australians 14+.

In the 12 months to March 2018, BPay was still by far the most used digital payment solution in Australia, with 53% of Australians using it in the past 12 months, followed closely by PayPal at 41%.

In recent times, the popularity of Buy-Now-Pay-Later payments has grown with 6% of Australians using at least one of those payment types, either Afterpay, ZipPay or ZipMoney, in the last 12 months.

Contactless/Cardless Mobile Payments

Contactless/Cardless Mobile Payments, where the payer must use the Near Field Communication (NFC) technology in their phone to tap a payment terminal, is an important part of transformation into a cardless society. This category covers both Banks’ Own Mobile Payments and other Contactless/Cardless Mobile Payments.

Banks’ Own Mobile Payments include CommBank Tap & Pay, ANZ Mobile Pay, NAB Pay, the former Westpac Tap and Pay before its discontinuation, and Other Bank Apps. In the past 12 months, 7.3% of Australians used a banks’ own mobile payment solution, with CommBank Tap & Pay the most used by Australians (4.3%).

Other Contactless/Cardless Mobile Payments include Apple Pay, Android Pay, Google Wallet, and Samsung Pay, with 6.1% of Australians using any of these Mobile Payment Solutions in the past 12 months. Apple Pay usage was almost twice as high as Android Pay (now Google Pay).

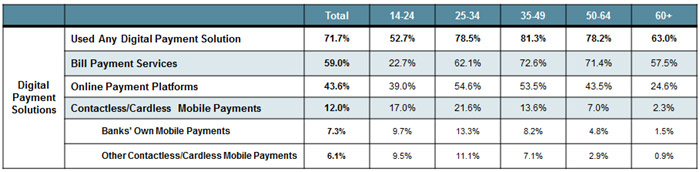

Payment Usage Differs Among Age Groups

Bill Payment Services are more popular among older age groups (35-64 years old). Australians aged 25-34 lead in using Contactless/Cardless Mobile Payments (either banks’ own or other contactless/cardless mobile payment) with the percentage using this payment category almost double the average (21.6% vs 12%).

Percentage using Digital Payments in the past 12 months – by Age

Source: Roy Morgan Single Source (Australia) 12 months to March 2018, n = 50,014.

Base: Australians 14+.

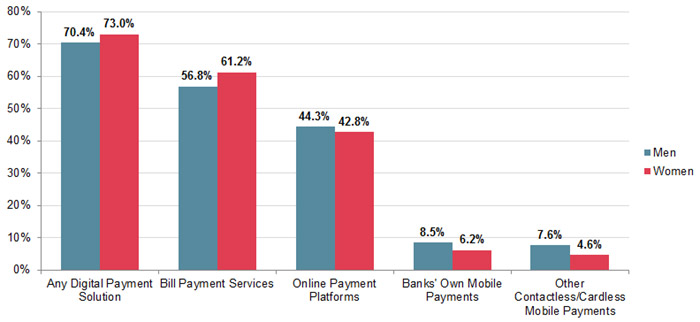

Gender Differences – Higher usage among men for Contactless/Cardless Mobile Payments

While men are more likely to use a Contactless/Cardless Mobile Payment (either banks’ own or other contactless mobile payment), women are more likely to be using a Bill Payment Service. .

Percentage using Digital Payments in the past 12 months – by Gender

Source: Roy Morgan Single Source (Australia) 12 months to March 2018, n = 50,014.

Base: Australians 14+.

Michele Levine, CEO, Roy Morgan, says:

“The way in which we make payments is evolving quickly. Tech companies, financial institutions and start-ups are competing to create ever increasingly frictionless payment experiences for consumers. These digital payments not only help the consumer with a quicker and more convenient way to pay, they also provide businesses with rich data on what the consumers are purchasing, how they are purchasing it, and where.

“It wasn’t too long ago that we were talking about moving to a cashless society, now we may be looking at a cardless society too, where holding a physical card is no longer a requirement to make a payment. It is already feasible for someone to go about their daily activities without the need for a physical wallet or card. This is being aided by the growing proliferation of smart phones and wearables with integrated payment technology such as Apple Pay and Google Pay, and an increasing number of financial institutions enabling their customers to make payments with these devices.

“The payment landscape will continue to evolve in the future. We are already seeing innovative new companies, such as Afterpay, changing the way in which people purchase goods that they cannot immediately afford. These ‘Buy-Now-Pay-Later’ companies may pose a threat to traditional payment types such as credit cards as well as traditional financial institutions as consumers can, in effect, access a small amount of credit instantly with no documentation.

“Innovative new technologies will change the way in which we make payments, not just in-store or online but even paying for a tradesperson or health service. The New Payments Platform (NPP) allows payments to be instant and frictionless. People will come to expect the minimum amount of effort when making a payment and the industry will need to adapt to these changing expectations by providing more innovative and seamless solutions. Traditional financial institutions may need to collaborate with Fin Techs and other third parties to keep up with the rapidly changing digital payment landscape.

“Of course, as with any new technology or innovation, take-up is not uniform. And anyone in the business of inventing technology knows that timing is critical. Being too early can be even more dangerous than leaving it too late. The critical issue is matching your customers’ expectations, desires, and current needs.

“For a deeper understanding of users of digital payments, our Digital Payment Profiles can provide an enriched look at these users, their demographics, attitudes, activities and media usage. To include tour customer readiness for frictionless payment systems.”

Subscribe to our free mailing list and always be the first to receive the latest news and updates.