SCOTT MURDOCH

SEPTEMBER 24, 2018

The Australian

The headwinds facing the Australian retail industry — from high wages and rents to cautious consumers — are not expected to ease soon, increasing the chance businesses will collapse and prompting ongoing consolidation in the sector, experts say.

A roundtable of the nation’s top bankers and lawyers specialising in the retail and consumer sector — hosted by The Australian — believes retailer numbers could shrink further in the next few years as a damaging two-speed trend in the sector plays out.

The group said the Australian market included local retailers that were performing strongly and a growing number of outlets, especially diversified chains, that were struggling.

“There’s definitely a clear gap between the winners and losers in the current market and I think that’s born out of the disruption you’re seeing in the marketplace,” UBS executive director David Raftis said.

“Some people have adapted to that better than others.”

Australian consumers spend nearly $26 billion a month, which makes the retail industry worth about $320bn a year.

However, the growth in spending in the past two years has flatlined as consumers become increasingly wary of the future and tighten their budgets.

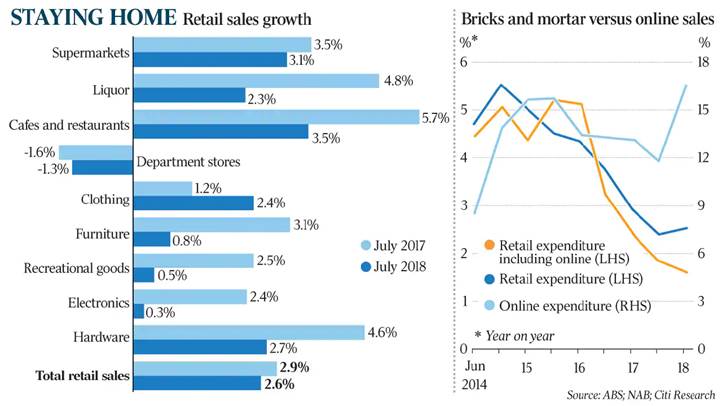

Retail trade in July was flat, according to the Australian Bureau of Statistics, and the result followed a 0.4 per cent increase one month earlier. The financial market consensus was a 0.3 per cent increase for the month.

The statistics showed a sharp 2 per cent drop in clothing, footwear and personal accessory spending while there was also a 1.2 per cent fall in household goods expenditure.

Despite the flat growth, there was a 0.3 per cent increase in food spending and a 0.6 per cent rise in cafe, restaurant and takeaway food expenditure.

So far this year, Toys ‘R’ Us has collapsed, Target has announced a major reduction in its store numbers, Specialty Fashion has been restructured and Oroton was rescued from collapse by private backing.

Myer recorded a 2018 full-year loss of $486 million, its first since listing nine year ago, and David Jones profit halved to $64m in the year ended June 30. Premier Investment’s profits for the past year slipped by 20.5 per cent to $83.6m after the company wrote down the value of major brands Just Jeans, Jay Jays and Dotti by $30m. However, bucking the trend of most retailers, Premier intends to nearly triple the number of its Smiggle specialist stationery stores.

Retail figures, experts say, show that Australian consumers are willing to spend money but are becoming increasingly selective in their purchases.

Arnold Bloch Leibler partner Jeremy Leibler said the divide between the well-performing retailers and struggling chains was similar to the situation that unfolded in the national economy during the mining boom.

“We were talking about a two-speed economy, and I think it’s the same in the retailing space,” he said.

“There is a sort of two-speeding retailing sector where you’ve got the really high-performing ones and the ones that are struggling. I think there will be growth, but predominantly it will be organically. The retailers who are doing well are constantly in tune with the trends overseas and what’s happening. They know what the consumer wants basically before the consumer does.”

Deloitte partner Victoria Brilliant said while the national focus was on the major retailers, which were struggling, a rising number of mid-market stores were performing well.

“The retailers that are doing exceptionally well in Australia aren’t necessarily the biggest retailers,” she said. “There are some in the mid market that never lost sight of the customer and the consumer and what drives the value in their brand.”

Credit Suisse’s managing director, Kate Stone, said the local retailers that had become too diversified were struggling and the downturn in spending in those stores was not expected to stop.

“The stores performing well have a very clear distinct offering and they know who they’re targeting and they make sure they continue to innovate and evolve with their key demographic,” she said.

“It’s really important for them to understand what they’re selling and who their target audience is. I think some retailers have struggled trying to be too much to too many people, and they don’t have a specific offering or a natural proposition. They’re just a combination of a lot of things.”

Bank of America Merrill Lynch managing director Duncan Hogg said the leasing costs, while still high, were starting to decrease, which gave retailers more bargaining power with shopping centre owners.

There is speculation that Myer could shut some of its 69 stores around the country as it attempts to reduce its $1.7 billion worth of lease liabilities.

“There’s an interesting situation with a number of the retailers at the moment. You’re now starting to see the balance shift between tenant and landlord and the retailers have a lot more power,” he said.

“The retailers have quite a bit of leverage with the landlords. Two years ago it was all about the power of the landlord and now you’re seeing more negotiating power with the retailers and you’re seeing some very, very good outcomes.

“I think, depending on the retailer, they are painting a realistic picture, they are saying ‘you’re either going to have me here at a lower rent or you’re not being to have be here at all either because we’re in trouble or there’s going to be a collapse. We’re going to have 100 stores, 200 stores in administration’.”

Ms Brilliant said retailers were increasingly looking to restructure their lease and rent liabilities.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.