10/18/2019

CSNews

BOSTON — Price and speed are a winning combination for convenience stores.

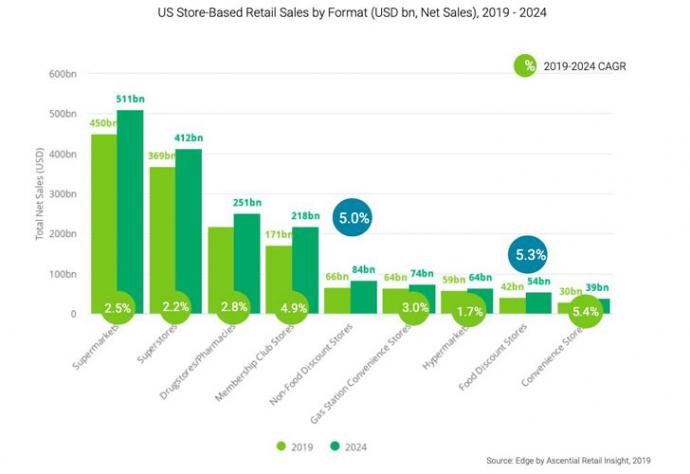

According to new analysis by Edge by Ascential, the U.S. convenience and discount channels are projected to grow faster than all other offline retail channels over the next five years, reflecting consumers’ increased focus on price and speed, even if it means more limited assortment.

Non-food discount, food discount and c- stores are all projected for annual growth rates above 5 percent, whereas all other offline retailers, aside from membership club stores, are projected at annual growth rates of 3 percent or below.

C-stores are projected for the highest growth at 5.4 percent, with discount and non-food discount stores projected at 5.3 percent and 5 percent, respectively.

The forecast seems to reflect broader economic trends. Paychecks remain relatively steady as unemployment continue at historic lows; however, wages remain stagnant for many workers, placing increased sensitivity on overall value, according to Edge by Ascential.

“What we’re seeing offline is similar to what we’re seeing online,” said David Gordon, research director at Edge by Ascential. “There’s an increasing emphasis on low cost and convenience. You can see it through the lens of Amazon, and it will continue to play out online in similar ways.”

U.S. projections are similar to global projections where convenience stores (6.6 percent), non-food discount stores (5.2 percent) and discount stores (4.9 percent) join membership club stores as experiencing the fastest growth.

Several retailers have already revealed plans to build new stores, the report pointed out. For example, Goodlettsville, Tenn.-based Dollar General Corp. is expected to open more than 900 new locations, with hundreds of locations adding produce and fresh foods to the mix.

The analysis also found that food discount stores are projected to continue gaining overall share, increasing to 9.7 percent of food sales in 2024, from 8.8 percent today and 7.4 percent in 2014.

Convenience stores will continue to thrive due to urbanization, declining household sizes and preferences for smaller shopping missions. They are also proving relatively resistant to share loss from online retailers, with only a .2-percent loss in share from 2013-2018, according to Edge by Ascential.

Discount stores are also seeking to future-proof their share. Many are partnering with online delivery intermediaries, which help support a last-mile solution that fits with the lower cost, low-complexity discount model.

The findings come from Edge by Ascential’s Retail Market Monitor, which analyses how individual sectors are currently performing and how they are forecast to grow by 2024.

Boston-based Edge by Ascential is a ecommerce insights company. It is a subsidiary of Ascential plc, a London-based global specialist information company.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.