While consumer bankers and analysts watch for smoke signals out of Chemist Warehouse, a big bolter’s reared its head after years off M&A and IPO watchlists.

7-Eleven, in the sin bin for the past five years, is back in bankers’ sights.

While there’s no formal process around it, the murmurs are starting to get louder.

It’s big, prominent and potentially attractive to strategic investors that have studied Australia’s convenience retail and fuel market to death in recent years. And it’s arguably sale-able for the first time in a long time, with the business said to be firing on all cylinders.

The question, though, is whether the Withers family, having pumped fresh money into the business to fix the underpayments issue, wants to call time on its involvement. It was the Withers and the Barlows, already operating in Australia’s grocery and grocery wholesale sector, that signed the area license agreement to bring the 7-Eleven brand Down Under and opened the first Aussie store in 1977.

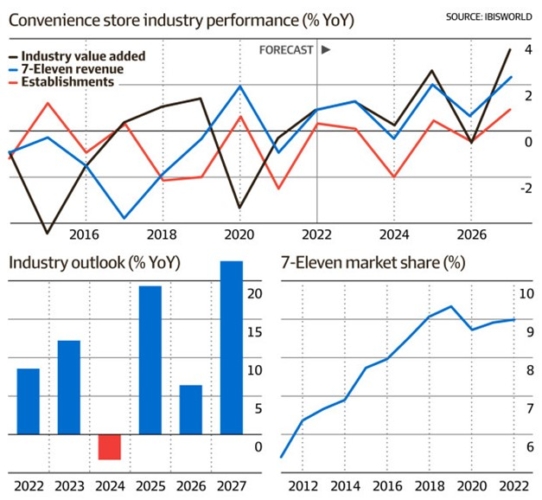

It’s grown dramatically since to become the biggest player in Australia’s convenience retail sector. 7-Eleven now operates a mix of company owned and franchised stores, tending to franchised stores to fuel its growth in the past decade.

Canada’s Alimentation Couche-Tard, having run hard at rival Australian fuel/convenience retailer Ampol, is the logical acquirer. Couche-Tard missed both Ampol and Woolworths’ fuels business, which ended up going to EG Group.

If it still wants into Australia, and saw something it didn’t like at Ampol, 7-Eleven could be the next best bet. Coles’ fuel business would be extremely difficult to extract given its tie-up with Viva Energy, while BP’s Australian assets are not for sale.

Analysts reckon other potential acquirers could be Chevron – the same company that sold out of Caltex – as a bolt on to Puma, or even a private equity group. KKR & Co had a close look at Peregrine Corporation’s On The Run a few years ago.

Like we said, it is understood there are no formal processes around 7-Eleven. But all of a sudden it is on dealmakers’ lips, which is as good a sign as any that it’s worth keeping an eye on.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.