Trends in mobility, food and tech will shape the global retail convenience industry in 2022 and beyond.

Retailers who lead and innovate in these fields will thrive. Those who don’t risk becoming irrelevant to shoppers, if not redundant. All three trends are consumer driven – in part or in their entirety – as shoppers actively search out new mobility choices, authentic and eclectic international cuisines and a frictionless in-store experience. As such, retailers need to get on the front foot and anticipate the next consumer behaviours and needs in each of these areas in order to delight shoppers and win their lifetime loyalty.

Here’s an overview of how they can adapt and succeed.

Electrification and e-mobility

Lessons from Norway as it continues to lead

Retailers who want to learn what the future of mobility looks like are turning to Norway, the global leader in EV adoption, for inspiration.

Shop Talk LIVE in November 2021 explored the progress of EV charging networks and infrastructure in Norway and globally in tandem with Circle K’s leadership team, focusing on the retailer’s proactive approach to e-mobility.

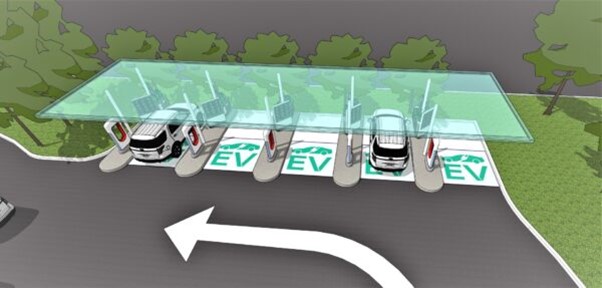

Circle K’s latest EV test site in Norway features 300kW charging stations plus a photovoltaic system supplemented by a battery pack of 200 kilowatt hours to ‘shave the power peaks’.

“Everyone is looking to Norway for big developments in EVs and new concepts,” Mariette Kristenson, the newly appointed Chief Executive Officer for Reitan Convenience, Nordics and Baltics, told Insight in December 2021.

The future of mobility is firmly on Reitan Retail’s radar. E-charging is offered on Reitan Retail’s roadside network and adoption is on the up. “It’s increasingly used by customers and becoming more user friendly for both users and operators,” Kristenson said.

Shell is making significant investments in the EV charging sector. At the retailer’s 2021 Global Growth event Istvan Kapitány, Executive Vice President Mobility, Shell, outlined the company’s ambitious plans noting that the business would “buy more EV charging posts in the next five years than petrol pumps”.

Kapitány shared how Shell was working with partners and suppliers on the energy transition and referenced its partnership with Waitrose to provide EV charging services at its supermarkets.

“If you have EV charging ambitions and need a partner, we are here to help you,” Kapitány said, highlighting the company’s EV charging investments in NewMotion and Greenlots plus Shell’s Recharge branded offer.

In Ireland, Junction 14, a state-of-the art-service station located off the M7 at Monasterevin, Co Kildare, launched the country’s first E-charging site last year. It provides four super chargers and two slow chargers, enabling a motorist to fully recharge within 30-40 minutes at speed.

Store manager Gavin Moran said the site is constantly busy with all chargers in use at peak times.

MOL Group, the international oil and gas company headquartered in Budapest, Hungary, is developing its mobility services capability across multiple streams. It is building its EV charging presence in order to increase network density with the aim of becoming the leader in EV chargers and connected services in 2025 and beyond.

In addition, it has launched a car sharing service in Hungary and operates a fleet management solution offering 4,000 fleet cars. Public transport is being tackled too – MOL Group operates 300 buses in an alliance with Mercedes Benz plus 2,000 share bikes,

Peter Ratatics, MOL Hungary COO and EVP of consumer services at MOL Group, told Insight all these elements had a role to play in the mobility revolution.

Latest statistics and incoming regulations in key regions

The tipping point in passenger EV adoption occurred in the second half of 2020 when EV sales and penetration accelerated in major markets despite the economic crisis caused by the COVID-19 pandemic, McKinsey & Company reports.

According to researchers, Europe spearheaded this development, where EV adoption reached 8% due to policy mandates such as stricter emissions targets for OEMs and generous subsidies for consumers.

In 2021, the discussions have centred on the end date for internal combustion engine (ICE) vehicle sales, McKinsey & Company states. New regulatory targets in the EU and the US now aim for an EV share of at least 50% by 2030, and several countries have announced accelerated timelines for ICE sales bans in 2030 or 2035. Some OEMs have stated their intentions to stop investing in new ICE platforms and models and many more have already defined a specific date to end ICE vehicle production, researchers add. Consumer mindsets have also shifted toward sustainable mobility, with more than 45% of car customers considering buying an EV.

McKinsey & Company predicts that the largest automotive markets will go electric by 2035. Europe will electrify the fastest and will remain the global leader in electrification in terms of EV market share, it says. This is due to regulatory pressure and positive consumer demand trends, researchers state. In China, the consumer pull is also strong, despite reduced incentives. In the US, meanwhile, EV sales have grown slowly due to both limited regulatory pressure and consumer interest, although the regulatory trend is set to change under the new administration, McKinsey & Company says.

Challenges for retailers

One of the biggest challenges for retailers is building the charging infrastructure to meet increasing EV adoption. “Building charging infrastructure in sync with the EV fleet will be essential in the coming decade, “McKinsey & Company claims.

While first-generation EV buyers have relied mainly on private charging, the next generation will depend on public charging, it says. More than 50% of Europeans will be living in multifamily homes without private charger access, researchers reveal. Public chargers will ensure practicality of EVs for long-distance trips, which prospective EV buyers still consider a main concern, they add.

“Electric vehicles are coming, and

we are on the right track regarding decarbonizing the transport sector, though

more actions need to be taken,” McKinsey & Company concludes. “It is an

industry transformation taking place at unprecedented speed. While a major

challenge, it represents a huge opportunity for incumbents and new players to

take a leading role in creating new multi-billion industries and jobs. The key

will be to couple sustainability with economic viability through innovative

technology and properly guided mobility transformation. Based on its diverse

mobility landscape, its focus on sustainability and its proven technology

leadership, Europe could emerge as a role model for other regions globally.”

Foodvenience

Foodservice destinations

Winning convenience retailers and forecourt operators are transforming their sites into foodservice destinations with a multitude of food and beverage brands. These sites provide consumers with multiple reasons to visit and typically adopt one of two formats: locations either feature recognised foodservice brands or they offer in-house, proprietary brands; often including hero categories. Some meld the two for a unique point of difference.

These foodservice destinations will feature on Insight’s upcoming market visit in Ireland in March and will include Junction 14 in Co Kildare, which has transformed from being a forecourt with food to a food court with fuel.

Junction 14 has a ‘big brand’ F&B strategy, developed following in-depth research with its customer base. Famous for coffee, the site features the Insomnia barista brand, alongside coffee available from the location’s other concessions.

There’s also Subway, Papa John’s for pizza plus its sister brand Supermac’s for burgers. Healthier options are provided by Chopped, while indulgence is catered for by Gino’s Gelato – Junction 14 is one of just three franchisees for the brand.

Mexican food has proved to be a

popular introduction too – Junction 14 has brought in Zambrero, a new brand in

the Irish market, which it is operating as a franchise model.

“Irish people love Mexican food and it’s done really well,” Moran reports.

Lion Place, a new forecourt and foodservice concept launched in Argentina by FGC Fuels Marketing, has looked to Europe and EG Group and Applegreen in particular for inspiration. These operators have engaged with franchise formats of recognised foodservice brands to provide the right credentials from the get go.

“We have forced ourselves to be different,” says Claudio Reboredo, one of FGC’s founders. “Today the world demands high quality fuels and food, prestigious and recognised brands, speed, minimal friction and comfort for consumers. The convenience store format must adjust and evolve for change. Our purpose and ambition is to create a concept in which consumers visit service stations because they want to, and not just because they need to or there is no other option.”

Lion Place is operating the Havanna franchise, Argentina’s leading and highly recognised coffee brand. The food offering, meanwhile, is complemented by the addition of a Subway, providing a concept with an attractive price and quality ratio, Reboredo says.

But FGC has put its own Argentinian-style spin on the new format with the launch of Tan Grill, an in-house fast casual restaurant, which combines traditional Argentine food – the grill – in a modern, convenience environment.

“Argentina is a meat country – the BBQ for Argentinians is a Sunday ritual, “ Reboredo explains.

“Our aim with Tan Grill was to try to capture an unfulfilled desire to be able to find a healthy, fresh, quality, fast offering in a modern convenience business environment with food prepared in sight.”

Looking ahead, FGC intends to give drivers more reason to visit its sites with a drive thru format possibly on the cards plus a tie up with Argentina’s second largest burger chain, Mostaza, for standalone QSRs alongside fuels and Lion Place.

“We need to be able to operate multiple formats because consumers are different and they are different at different times of the day too,” Reboredo says.

In the US market, Dom’s Kitchen & Market, opened in Chicago in June 2021, is curating its own rich culinary experiences and brands. The store leads with foodservice and competes with restaurants rather than grocery chains.

The are five key Kitchen elements:

- The Hearth: offering Boncipizza and rotisserie meats

- The Stackup: serving sandwiches

- Plant Butcher: featuring made-to-order salads

- Gohan: selling sushi, Asian rice bows, and katsu sandwiches

- The Brew: a coffeeshop and wine bar with cocktails

These Kitchen sub brands take

centre stage in the store’s layout and are focused on discovery and creation,

according to co-founder Don Fitzgerald.

“The heart and soul of Dom’s is the Kitchen and the layout then fans out

towards cooks’ ingredients and pantry items plus wine that pairs well with

food. The heartbeat is the Kitchen and then we push the culinary experience out

to the perishable perimeter,” he says.

Other convenience retailers who are successfully leveraging their own brands in foodservice include Casey’s, the Mid West, US convenience store chain and MOL Group with its Fresh Corner concept. While Casey’s restaurant offer features regular hot fare such as hamburgers, cheese burgers and chicken tenders plus subs and salads, it’s famed for its pizza and makes its own pizza dough in store.

While pizzas were launched in the early 1980s, Casey’s has not stood still and has recently introduced a breakfast pizza featuring egg, cheese, bacon or sausage or veggie toppings to expand the day part for the range.

MOL Group launched its Fresh Corner format four years ago and has gathered a considerable amount of experience and knowledge plus customer feedback on the concept. Today the brand features two hero products: coffee and hot dogs.

Through Fresh Corner, MOL Group is the largest coffee retailer in the region, selling 53m cups annually. Hot dogs are now a significant contributor too with 12m units sold a year.

Retailers should look to Casey’s and Fresh Corner for inspiration on ‘famous for products’ and consider the categories in which they too can differentiate and excel.

Fresh

Fresh is another watchword in developing a foodservice destination. It marks stores out as different and, for forecourt locations, can be an unexpected but extremely welcome surprise; as Skye Jackson, head of merchandise planning at Ampol, Australia’s largest fuel retailer revealed last year.

The retailer introduced a new fresh produce area at the front of its Ampol Woolworths Metro premium store format. “It’s disrupting the customer when they walk through the door. A produce stand with an abundance of bananas makes you instantly acknowledge that there’s something different here and sets the tone about what you can expect from the rest of the offer,” Jackson said.

David Jones is also pushing the fresh message in Australia at the forecourt sites it operates in partnership with BP. Prior to the tie up, BP’s offer was akin to a traditional CTN offer within a forecourt network. The first dual sites were opened at the close of 2018 with an initial 10-store trial, expanded to 31 sites by the end of 2020.

The aim was to deliver fresh, high quality products and innovative convenience and shape the way Australian consumers shop for food.

The David Jones name sits above the door, although the forecourt is branded as BP. “We try to give a sense to customers that they are in a corner of a David Jones food store,” said Paul Horwell, head of food buying at David Jones.

The Covid-19 pandemic has helped to boost sales of fresh foods and locally sourced produce, with shoppers turning to local, convenience stores for these lines. Coming out of the crisis, these trends are poised to continue. In Switzerland, for example, neighbourhood stores have been boosted by linking with local farmers, who were unable to sell direct from their farms during the crisis, to sell their fresh produce in their stores.

In a similar vein, c-stores have started to co-operate with local bakeries to produce sandwiches on their behalf and have introduced local cheeses, meats and regional wines.

“People love that,” said Marco Fuhrer, managing partner at consulting and marketing research company, Fuhrer & Hotz, and the NACS relationship partner for Switzerland.

“They want a freshly made sandwich with top ingredients and appreciate that if a bakery is producing it, they are professionals. Some people have a psychological barrier about something that is freshly made but by people who are not professionals preparing food ie people working in a store or forecourt.”

Retailers could also take a leaf out of Migrolino’s book. The Swiss retailer developed and unveiled the new Gooods convenience retail concept during the pandemic, which takes the latest trends regarding super foods, nutrition, product provenance and organic products to the next level.

“It’s the first time the focus has been that strong and aimed at people who want to live that way and spend a little more,” Fuhrer says.

The growth in fresh foodservice and consumer desire for added convenience will shape another trend – delivery. Reitan Convenience, for example, plans to expand fresh foodservice, an area where it is seeing good growth. It is also taking its first steps with partnerships for e-commerce and delivery and has teamed up with Take Out in Denmark to deliver a fresh food proposition.

According to PDI CEO Jimmy Frangis, COVID-19 has accelerated the need for retailers to solve the challenge of last mile delivery. Not only are retailers implementing order ahead and delivery technology faster than many thought possible, but that added convenience has permanently altered customer expectations, he says.

Expect fresh foods delivery to accelerate in 2022 with retailer partnerships with the likes of Deliveroo and Uber Eats escalating further.

Technology

The digital interface with customers

Retailers around the world are trialing a raft of new technologies to provide a frictionless customer experience in their stores. Accelerated by the Covid-19 pandemic, these new solutions help enable contactless and ‘safer’ physical store environments.

In the UK, Amazon is rolling out its Amazon Fresh concept, powered by ‘just walk out’ technology. Fifteen plus stores have been opened in the London area to date. To shop the Amazon Fresh store, customers simply use the Amazon app to enter and can put their phone away and shop for what they need like normal, bagging items as they go. At the end of their shopping trip, they can just walk out, no stopping to stand in queue or check out.

Walk out tech is the featured topic in a new Shop Talk LIVE episode, co-hosted by Insight managing director, Dan Munford, and Frank Beard, marketing and customer experience executive at autonomous checkout specialist, Standard AI. It explores the varying technologies including sensor fusion and computer vision and considers how retailers can continue to build customer relationships when the machinery of the transaction has been taken away.

Munford and Beard discuss why they find the trend fascinating and their recent experiences of Amazon Fresh, Tesco GetGo, Sainsbury’s SmartShop Pick&Go, Woosox Market, plus thoughts on Carrefour Flash and ADNOC’s new frictionless store. A retail perspective is provided by Compass Group’s Scott Wu, who shares the company’s journey into autonomous checkouts.

Reitan Convenience is also trialing unmanned stores. Working in partnership with Swedish company Instant Systems, the retailer has opened four ‘walk in, walk out’ stores to date in Sweden and Finland with Denmark next in line. According to Kristenson, there are a lot of players currently testing unmanned concepts and the key lies in understanding the customer needs and expectations in this marketplace.

Gooods in Switzerland is a digital-first convenience store too. Shopping is done via Migrolino’s app, which consumers download and use to scan and pay for goods. But there’s also a manned checkout for age restricted products such as tobacco and alcohol.

Checkout-free technology is tipped as the next trend within retail technology to gather momentum by RBR in its its Mobile Self-Scanning and Checkout-Free 2021 report.

Ubamarket, a pioneering retail app, has been on the front lines of innovation in the retail sector in the UK, and is helping supermarkets and convenience stores to revolutionise their operations by integrating such technology.

The Scan, Pay, Go app Ubamarket provides is currently being implemented by a list of retailers including Central England Co-op, Spar, Budgens and Nisa, with key features such as age verification, aisle sat-nav and AI-driven personalised offers proving instrumental in helping physical retail outlets transform their service offering to compete in a post-COVID landscape. Testament to the necessity of retail technology, the implementation of Ubamarket has helped partners increase basket size by 21%, while customer loyalty has been enhanced with store visits up by 300%. Ubamarket allows consumers to check out while in-aisle, saving them time and giving them full control of their shopping experience.

Will Broome, founder and CEO, says: “Ubamarket’s mobile technology helps retailers to offer customers an incredible experience when they come to shop at their stores. Not only does our technology revitalise and revolutionise the process of shopping in-store for customers, but it also provides retailers with a much-needed method to get back on track and ensure they can thrive in the midst of a tough climate for the industry.”

Invenco and Gilbarco Veeder-Root are also helping retailers provide a frictionless experience and enhance the CX. Invenco’s suite of products includes pay-at-pump terminals, IoT retail microservices solutions and a cloud-based management platform. Invenco has an open platform approach that is modernizing the forecourt with increased customer engagement opportunities facilitated by agile infrastructure implementations.

As with investment in the mobile application space, new systems are designed to enable new engagement opportunities, which make it easy for customers to get what they need in a convenient way for them; be that delivery to their door, having an order ready when they drive up to the shop or being in the right geographic location for customers to stop and get what they need, when they need it.

Gilbarco

Veeder-Root, the world’s leading fuelling and convenience store equipment and

technology manufacturer, aims to be the best end-to-end supplier of the

forecourt and c-store. Whether that’s a solution for a driver looking to

recharge their electric vehicle or looking to fill up their petrol car with

fuel, or a consumer looking to make a quick pit stop for coffee or lunch, the

company has the end-to-end solutions.

These include the back-end cloud software to help manage networks of electric

vehicle chargers, EV driver app software to initiate charging sessions, and

software to orchestrate predictive and preventative maintenance of equipment to

ensure maximum uptime, for example.

“We are giving our customers the solutions that matter, such as best-in-class

dispensing and payment solutions with seamless and rich digital experiences and

the latest in frictionless payment technology, such as automatic number plate

recognition (ANPR),” Om Shankar, European Marketing Director states.

Circle K’s new ‘pay by plate’ technology is exactly the kind of frictionless innovation the European consumer wants. Circle K is the first fuel retailer to introduce Pay by Plate across Europe at scale, which allows customers to pay for fuel using their number (license) plate, offering a frictionless customer experience.

Following a successful pilot in Norway, Pay by Plate technology was expanded to Sweden, and Circle K Europe parent company Alimentation Couche-Tard Inc. plans to expand the innovative technology across its Circle K network.

To use Pay by Plate, customers simply drive onto the forecourt, fill up with fuel and, through number plate recognition, pay for the fuel on the Circle K Easy Fuel app. The technology behind Pay by Plate aligns with established number plate recognition technology used at road tolls and parking garages/carparks across Europe, making it familiar to many European motorists.

“The move towards a more frictionless forecourt experience is driven by the clear changes we see in consumer behaviour. As market leaders, we feel it is our responsibility to continue pushing forward the development of the forecourt and convenience retail space and ensure we are adapting today to meet the future needs of our customers,” says Deb Hall Lefevre, chief information officer at Circle K.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.