ELI GREENBLAT

April 30, 2018

The Australian

German supermarket giant Kaufland has told grocery suppliers to prepare for the opening of its first stores this year as they scramble to fill some of the estimated 35,000 individual product lines a typical Kaufland store can sell and forge a new wholesale revenue stream beyond the dominant Woolworths and Coles chains.

Suppliers contacted by The Australian and operating in the household goods and personal care sectors said they had had some contact with Kaufland and were told to expect the first Kaufland store to open next year.

Kaufland has also begun to widen its search for retail executive talent beyond fresh food and grocery, with it now looking to hire a buyer for the fashion and accessories category as well as a buyer for homewares.

Kaufland is continuing to advertise online for candidates to fill its “future leader program’’ that promises travel to Germany for nine months of intense training, including learning a smattering of German “to ensure nothing is lost in translation’’, according to the job advertisement.

The reach for executives with a deep knowledge of fashion, accessories and homewares marks a new tactic for Kaufland and should send shockwaves through the ranks of general merchandise chains — especially those owned by Woolworths and Coles, such as Big W, Kmart and Target — as the discount German retailer further marks out its territory for its assault on the $90 billion Australian grocery sector.

Over the past few months, Kaufland has advertised widely for executives with specialties such as property, property development, business intelligence, fresh food purchasing and marketing chiefs, but is now for the first time seeking to hire retailers with experience in fashion and homewares.

It’s highest-ranked scalp to date has been the appointment of former Woolworths and Metcash executive Mark Hewlett as chief operating officer, and now it could be going after executives from general merchandisers like Big W and Kmart to fill out its executive ranks.

Kaufland, one of the world’s biggest supermarket chains, is flush with cash to splash on new appointments. Last year it received $43 million in funding from parent company Schwarz Group and spent $25m acquiring the Le Cornu site on Anzac Highway in Forestville, on the fringe of the Adelaide CBD.

Kaufland, a global supermarket with more than 1230 stores in Europe and more than 150,000 staff, could open as many as 10 stores a year in Australia when it launches next year through buying up property and securing long-term leases.

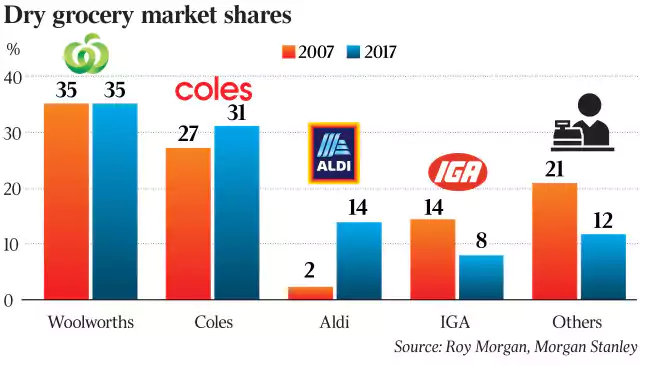

Morgan Stanley analyst Thomas Kierath wrote in a recent in-depth report into Kaufland’s Australian ambitions that given the range of Kaufland store formats, it should be able to roll out new stores here faster than recent arrivals Aldi and Costco.

“Kaufland’s flexible store format approach should enable a faster rollout. Since Kaufland operates stores from 3000 to 20,000sq m we think that it will more easily find appropriate sites compared with Aldi and Costco that have more a cookie-cutter approach to store rollout,’’ Mr Kierath said.

There might also be an opportunity for greater store openings as department stores shrink their footprint, allowing Kaufland to move in.

“Australia has on a per capita basis the most department store space per capita among major developed economies. Over the coming 5-10 years we expect the department stores to operate considerably less space as Amazon enters the market.

“Today the department stores (David Jones, Myer, Kmart, Target and Big W) collectively operate more than 800 stores or about 4.5 million square metres — if just 5 per cent of these stores were closed it would enable Kaufland to open 40 stores.”

Morgan Stanley estimates that, based on European penetration, Australia could support as many as 295 Kaufland stores longer term and that its annual sales in Australia could hit more than $3 billion from 56 stores within six years of its first store opening.

“Our sales density forecasts aren’t aggressive. In the same way that it took consumers a long time to fully ‘accept’ Aldi as a mainstream supermarket, we think that it will also take consumers time to adopt Kaufland.’’

Subscribe to our free mailing list and always be the first to receive the latest news and updates.