Amazon will make Australian business leaders look again at their data strategies. Picture: AFP

ROBERT GOTTLIEBSEN

July 26, 2017

The Australian

Amazon last year globally recruited around 100 PHD economists from around the world, plus an army of people doing data analysis, and even human behaviour people.

No company in the world has seen value in a mass hiring of economists and clearly looks at the future in an entirely different way to conventional companies.

The Amazon challenge is going to make Australian chief executives, retail and non-retail, look again at their data strategies and will create a big shortage of talent in Australia and around the world.

I will look later at the looming global talent squeeze. But why would Amazon recruit 100 economists, many with the unfair reputation of being statistical boffins remote from the real world?

Amazon’s rivals would like to think that the US giant is trying to over-analyse the world economies. But that’s not the reason. The true answer goes to the heart of what makes the Amazon operation unique in the world.

When Australian retailers, banks, power utilities and others using data-based operations discover why economists now have a new career path in data, don’t be surprised if others follow Amazon and seek to hire economists, as well as data analysis and human behaviour people.

If Amazon is to succeed in Australia, first they must get access to goods and be able to execute an online ordering business that is equal or better than anyone else here. It has now acquired base distribution points in Melbourne and Sydney, but that’s just the beginning. It then has to set up its prime customer system, where people pay money to be Amazon customers. This will not happen overnight, so I am not expecting Australian conventional retailing to suddenly go into severe decline.

But if the US pattern is duplicated, Amazon will dominate online growth, which is where future retail action will be.

Amazon has already woken up many large Australian organisations. Probably Australia’s leading data management education centre is the Melbourne Business School’s centre for business analytics, which has studied the Amazon data operation from all angles and is being rushed by mature-aged students from around the country — often-corporate executives.

Amazon has found that it is one thing to accumulate vast amounts of data and another to correctly interpret that data. Economists have the ability to study the data and isolate the causes of major moves. Their talents enable Amazon to carefully construct experiments to refine the conclusions that the economists and others have reached about the causes of the trends in the data.

The object is to refine Amazon marketing skills by developing accurate predictions of future customer buying.

Being able to carefully set up experiments to gain conclusions from data is a key to the global Amazon operations.

Australian companies have not been skilled at gaining conclusions from their databases. However, in supermarkets both Coles and Woolworths are at the cutting edge. Amazon will not bowl them over quickly because they have prepared. But on my experience as a customer, neither Bunnings nor Harvey Norman have done the work.

JB Hi-Fi emails customers but does not tailor its offers. It purchased Good Guys, which is behind JB Hi-Fi in the use of customer data. The success of Myer, David Jones and other department stores may depend on their use of databases. As power utilities, banks and other enterprises with large database see what’s happening they, too, may wake up from their slumber.

That’s going to explode the demand for data analysts.

Amazon has encountered great difficulty in finding Australians with the required skills. Most of those who developed such skills gave gone overseas. In addition, too many Australian students foolishly dropped higher maths. Amazon is being forced to ship talent to Australia to undertake the expansion Down Under. As Australian companies seek to improve their use of data, Australian enterprises will encounter a severe talent shortage, but it’s part of a world problem.

Global management consultants ATKearney summarise the world position this way:

“Companies have greater access than ever before to data that can create real value and a long-lasting competitive advantage.

“But at the forefront of this revolution is talent: the smart, driven people needed to work seamlessly at the intersection of technology, analytics, and business.

“To compete in today’s world, organisations must recruit, develop, and retain the best digital and analytics talent — not just people who are pushing out reports, but rather a new breed of worker proficient in technology, core critical thinking, and analytics, who can combine those skills with an understanding of business strategy and how to transform key functions.

“Much as quants revolutionised the financial industry in the 1990s, the best analytics talent is changing the way companies do business — taking the data and turning it into truly usable insights.

“One way to look at this leading talent is as ‘trilingual’: people well versed in the languages of analytic modelling, technology, and business. These trilinguals are analytical and creative, insightful and inquisitive, and willing to look outside the box for new solutions.

“Capturing these types of knowledge workers has proven complex and difficult for many companies, especially those trying to play catch-up. The supply of truly top talent — those with the right combination of business and technical skills — is well below demand, and competition is driving up prices.

“The executives we surveyed for our second Leadership Excellence in Analytic Practices (LEAP) study highlight this shortage; two-thirds of the companies we identified as ‘leaders’ — those with the most advanced digital and analytics capabilities — have been unable to meet the demand for such talent

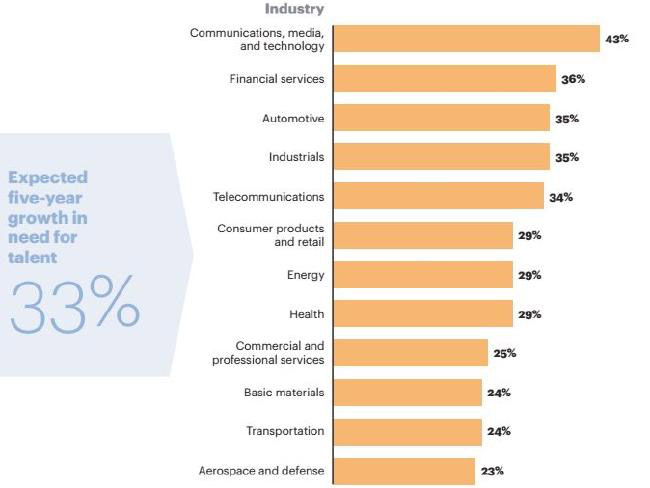

“And the need is growing — an estimated 33 per cent more talent will be needed over the next five years, in growth that is cutting across all fields”.

How much more “digital” and “analytics” talent do you expect to need over the next five years? Source: ATKearney.

Kearney concludes: “many companies simply don’t know what they want from their digital and analytics employees and don’t do what it takes to attract and retain them”.

ATKearney’s global description applies perfectly to Australia.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.