Eylem Mustafoff

August 29th, 2017

IBIS

Soft drink manufacturers have faced challenging conditions over the past five years, with many consumers opting for bottled water and healthier alternatives to carbonated soft drinks. As a result, manufacturers have focused on producing diet and low-sugar drinks. However, with this market already saturated, supermarkets are carefully considering the value of stocking additional products. Recently, Woolworths chose not to stock the new Coca-Cola No Sugar, showing that a continued focus on diet soft drinks may not be a strong growth driver for soft drink manufacturers. IBISWorld expects that revenue among soft drink manufacturers will decline by 1.1% in 2017-18.

In recent years, Coca-Cola Amatil Limited (CCA), Australia’s largest beverage manufacturer, has struggled to address changing consumer demands. CCA has exclusive bottling rights to the Coca-Cola brand within Australia and launched the new Coca-Cola No Sugar in June 2017 to address changes in consumer health trends. However, retail giant Woolworths has refused to stock the new sugar-free cola because its customers already have a range of diet and low-sugar drinks to choose from. Shelf space at Woolworths is a valuable asset and with consumers changing to healthy alternatives such as bottled water, adding another sugar-free carbonated drink to store shelves isn’t an attractive option. Although Coles has agreed to stock Coca-Cola No Sugar, Woolworths’ decision shows that CCA’s focus on diet soft drinks may not be enough to drive revenue growth for the company.

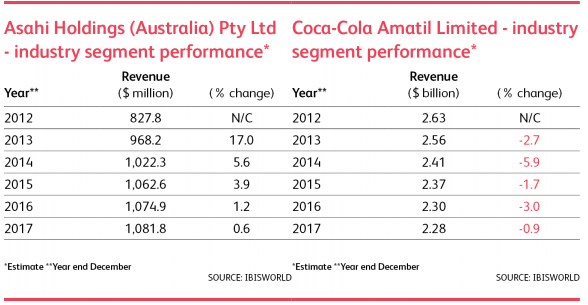

CCA’s revenue from soft drink manufacturing fell by 3.0% in 2016. CCA continues to face tough trading conditions with intense competition from Asahi Holdings (Australia) Pty Ltd. Asahi Holdings is a Japanese-owned manufacturer that has exclusive bottling rights to the Pepsi brand in Australia. In 2016, Asahi’s revenue from soft drink manufacturing grew by 1.2%. Although CCA has over 50% of the market share for soft drink manufacturing in Australia, Asahi’s competitive bids for large contracts shows it is a growing force. In June 2017, following Woolworths’ decision not to stock Coca-Cola No Sugar, CCA lost a large contract with Domino’s Pizza, with the fast-growing enterprise choosing to stock the Pepsi and Schweppes variety instead. The loss of the multimillion-dollar Domino’s contract is likely to make it difficult for CCA’s soft drink manufacturing segment to maintain growth. CCA’s revenue from soft drink manufacturing is expected to fall by 0.9% in 2017.

Soft drink manufacturers are struggling to address changes in consumer health trends, with consumers forgoing carbonated soft drinks for bottled water and other healthier alternatives. CCA’s recent issues with the introduction of Coca-Cola No Sugar show that releasing a new diet soft drink product in an alreadysaturated market may not be the answer. With revenue from soft drink manufacturing expected to drop further in 2017-18, CCA will need to explore healthy drink alternatives outside of diet and low-sugar drinks to remain competitive. As manufacturers like Asahi continue to enter competitive bids for large contracts, CCA cannot rely on its large market share for its ongoing success in soft drink manufacturing.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.