The Australian Government’s latest plan to crack down on illegal tobacco does not go far enough, falls well-short of the funding needed to address the crisis and will target the wrong people, the Australian Association of Convenience Stores (AACS) has warned.

AACS represents more than 70,000 Australian workers who have been subject to years of intensifying intimidation, threats of firebombing and violent attacks, as international and domestic crime groups go to war over control of Australia’s multibillion dollar black tobacco market.

“We have seen crackdown after crackdown and funding announcement after funding announcement from consecutive governments about illegal tobacco, and none has worked,” AACS CEO Theo Foukkare said.

“Today’s day is no different – it treats the symptom of the illegal tobacco wars, not the cause – and the $156 million fund to try and stop the crisis once and for all is a just a drop in the ocean compared to the huge profits being pocketed by these criminals.

“The Federal Government plan is like trying to use a nut to smash a sledgehammer.

“If the Government is serious about illegal tobacco, it would do two things – stop the illegal tobacco boats and pause the excise rises on legal tobacco, which clearly makes illegal tobacco more attractive to adults who choose to smoke and are trying save a buck during the out-of-control cost of living crisis.

“Today’s announcement does neither of those. It treats the symptoms and ignores the cause not the problem itself,” Mr Foukkare said.

A new expert report by Tulipwood, commissioned by AACS found – by next year -the largest supplier of tobacco in Australia will be international crime groups selling illegal, unregulated cigarettes and vapes.

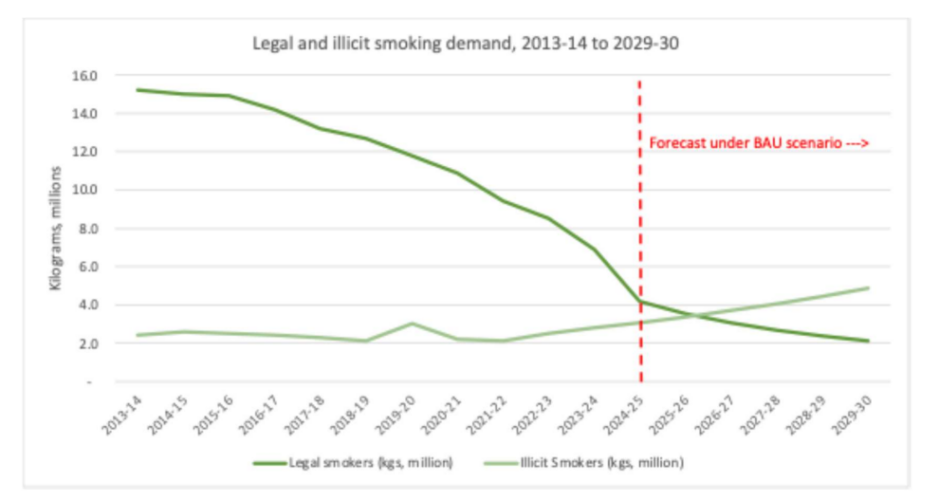

The report shows consumption of illicit tobacco will overtake the use of government regulated tobacco in 2026-27, despite the Federal Government’s failed efforts to try and curb the crisis.

The Tulipwood modelling shows the combination of an excise freeze, strict legalization and the regulation of vaping products, as well as a heavy crackdown on criminal black-market operators, would deliver an additional $18.6 billion in excise revenue to Australians over the four years from 2025-26, as well as $2.3 billion in additional GST revenue.

“The definition of insanity is doing the same thing over and over and expecting a different result And today’s announcement is them doing exactly that,” Mr Theo Foukkare said.

“The argument for frequent excise hikes has always been that it will encourage smokers to quit and raise government income to cover health related costs and public education quit smoking campaign – but instead, smokers are continuing to turn to the cheaper and illegal black-market product.

“If the Federal Government ignores these warnings, taxation revenue is forecast to decline from $8.3 billion in 2025- 26 to $7.6 billion in 2028-29, while at the same time demand for illicit tobacco will increase from 3.3 million kilograms annually to 4.3 million kilograms,” Mr Foukkare said

REPORT SUMMARY

New modelling shows that by 2026-27, there will be more illicit tobacco smokers than legal smokers in Australia – which means unless urgent action is taken, from next year international drug groups will be the major supplier of tobacco in this country.

The intention of frequent, above-inflation increases in tobacco excise is to a) encourage smokers to quit and b) raise revenue for the health system. The outcome is that they have fuelled increasing consumer demand for cheaper, black market and untaxed products.

Analysis across several data sources shows that while there may be fewer smokers overall, more smokers are using illicit products, and those smokers are smoking more tobacco products.

There is a significant gap when comparing the decline of legal tobacco sales to the decline of daily smokers. Between 2019 and 2023 the daily smoking population dropped 24.5 percent, while legal tobacco sales declined 41.6 percent.

The consumption of legal tobacco has fallen from 15 million kgs (2014-14) to 4.2 million (2024-25) in a decade. At the same time, the consumption of illicit tobacco rose from 2.6 million kgs to 3.1 million.

The high price of legal tobacco compared to illegal tobacco is the main driver of this trend. The other is that supply of illicit tobacco is a low-risk, high-reward crime, with penalties for supply much lower than illicit drugs like cocaine, but the gross profit margin being higher.

If action is not taken:

– Excise revenue is forecast to decline from $8.3 billion in 2025-26 to $7.6 billion in 2028-29.

– Legal tobacco demand is forecast to fall from 3.6 million kgs per year in 2025-26 to 2.5 million kgs in 2028-29, but illicit tobacco demand will increase from 3.3 million kgs to 4.3 million kgs per year.

– Public health costs will continue to mount without being offset by the excise revenue.

– Governments will need to raise other taxes to compensate for revenue loss.

– The cost of enforcing tobacco licensing laws and detecting illicit products at the border will continue to rise and be borne by the taxpayer.

THE SIMPLE SOLUTION:

Based on the economic modelling, the AACS Tulipwood report recommends:

A heavy crackdown on illegal tobacco, with a joint effort between Commonwealth and State to stop illegal tobacco imports at the border and increase penalties.

– Together, an excise freeze, legalisation of vaping, and a heavy crackdown would deliver an additional $18.6 billion in excise revenue over the four years from 2025-26, as well as $2.3 billion in additional GST revenue.

– The consumption of illicit tobacco for the four years from 2025-26 to 2028-29 would drop from 15.1m kg to 9.5m kg. Total tobacco consumption would be up from 28.5m kg to 33.3m kg, driven by illicit users returning to the legal, taxed product. The benefit to such would be that smokers returning to the legal market would interact with tobacco control measures such as health warnings and health inserts.

– An excise reduction scenario, with legalisation of vaping and a heavy crackdown, in which the excise is reduced by 20.6% back to September 2019 in 2025-26 and then rises at 4.4 percent per annum, would deliver an additional $17 billion in excise revenue over four years, and an additional $2.1 billion in GST revenue.

-The consumption of illicit tobacco for the four years from 2025-26 to 2028-29 would drop from 15.1m kg to 5.8kg. Total tobacco use would increase 12m kg.

A freeze on tobacco excise for four years to support urgent recalibration of the current policy settings to

ones that will increase taxation revenue and drive down smoking rates.

Legalisation, regulation and taxation of smoking cessation and alternative products, like vaping, that drive

smoking rates down around the world.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.