25th February, 2021. The Australian

Eftpos will roll out a national QR codes payments system for online shopping that takes advantage of the public’s recent take-up of QR codes for contact tracing.

The move will also see the Australian payments network able to edge in to online transactions, which until now has been dominated by global card schemes Visa and MasterCard.

Eftpos chief executive officer Stephen Benton said the Australian public had embraced checking into venues with QR codes, so eftpos saw an opportunity for adapting QR codes to payments across the country.

“The QR code payments network will enable local homegrown innovation by connecting numerous APIs, consumer digital wallets, and providing choice and potential cost savings for local businesses,” Mr Benton said.

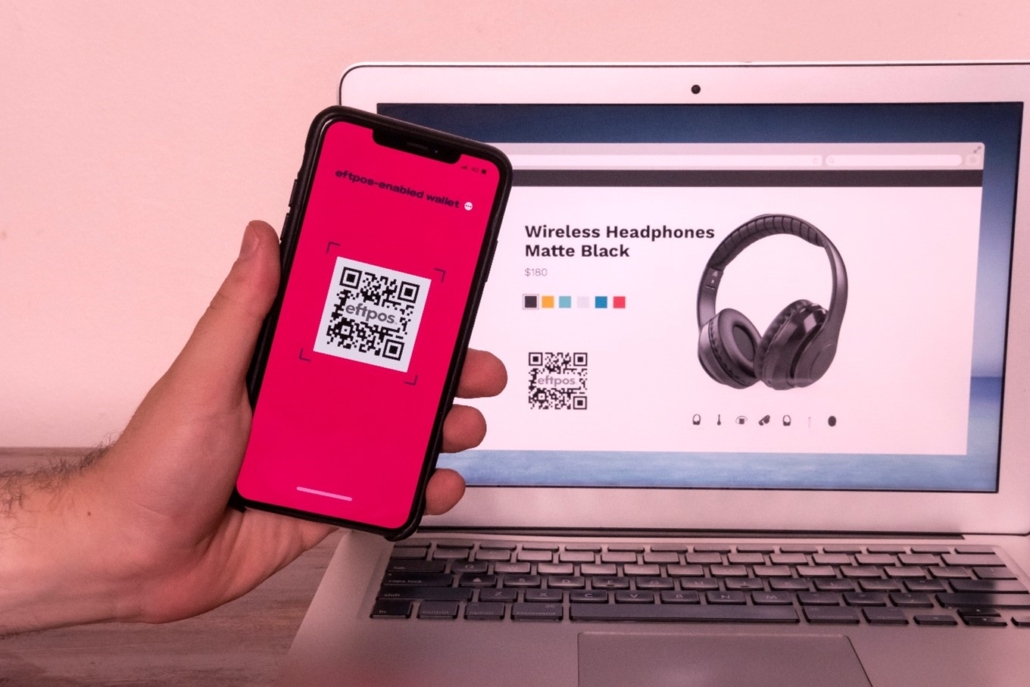

The public can pay by QR code online, by mobile and in stores. QR codes containing transaction details are captured on a consumer’s mobile phone, initiating a secure digital wallet payment that is connected to the merchant’s loyalty service provider.

When buying goods from an online store, customers can point their phone at a QR code on their computer screen to finalise payment. eftpos said customers wouldn’t need to enter payment details manually.

When buying using their mobiles, customers would press the QR code on their touch screen for a payment. Capturing a QR code would be another option available through payment terminals in shops.

Eftpos said the QR codes payments network would be trialled by mid-year with a national rollout to be completed in 2022.

It said QR code payments would be linked to existing loyalty and reward card options, offers, receipts and more, driving customer engagement. It said debit card transactions represented 67 per cent of transactions overall, and was Australia’s most used payment type.

“It is much better to run this type of network domestically, rather than depending entirely on big tech multinationals which will move into this space at some point soon,” said eftpos in a statement.

QR codes haven’t been used in this mode for payments in Australia, however eftpos said they were used extensively for payments in China and parts of Asia.

An eftpos spokesman said QR codes would lift eftpos’s market share in online shopping. It would see eftpos offer new competition in online payments and e-commerce in Australia.

Eftpos is a low cost payments provider so its presence should help drive down transaction costs for consumers.

The National Online Retailers Association has welcomed the initiative. Director Adéle Walters-Greenberg said QR code payments brought much needed competition to online payments as Australians increasingly shifted to the online retail marketplace.

“The move quickly follows off the back of eftpos commencing digital payments for card-on-file transactions, their acquisition of the payments app ‘Beem It’, and the piloting of their digital identity solution connectID using the eftpos payments network.”

Subscribe to our free mailing list and always be the first to receive the latest news and updates.