Chains such as Circle K and Casey’s General Stores are seeing appetizing margins from selling food.

Most people still think of convenience stores as just a pit stop for gas, a quick snack and a bathroom break.

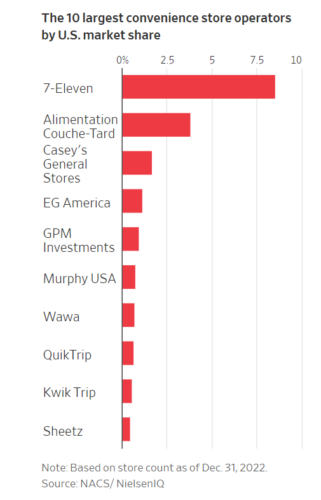

Not so at Casey’s General Stores a Midwest chain that also happens to be America’s fifth-largest pizza purveyor by number of kitchens. About three-fourths of transactions inside its stores don’t involve a fuel purchase. Meanwhile Wawa, an East Coast-based chain, has a cultlike following for its sandwiches.

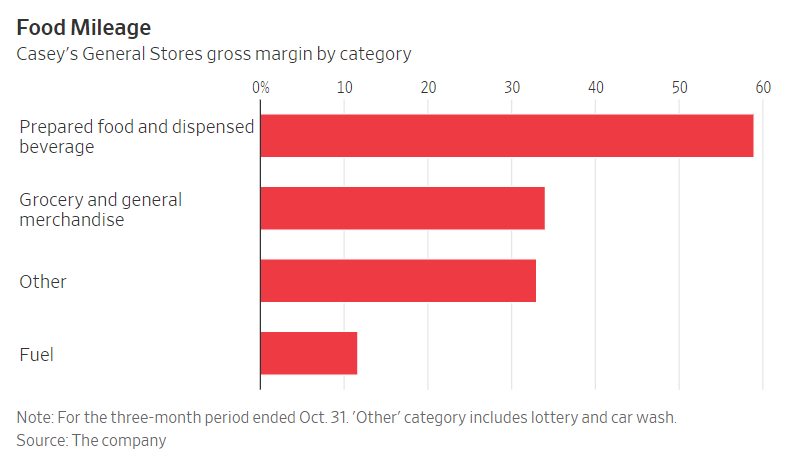

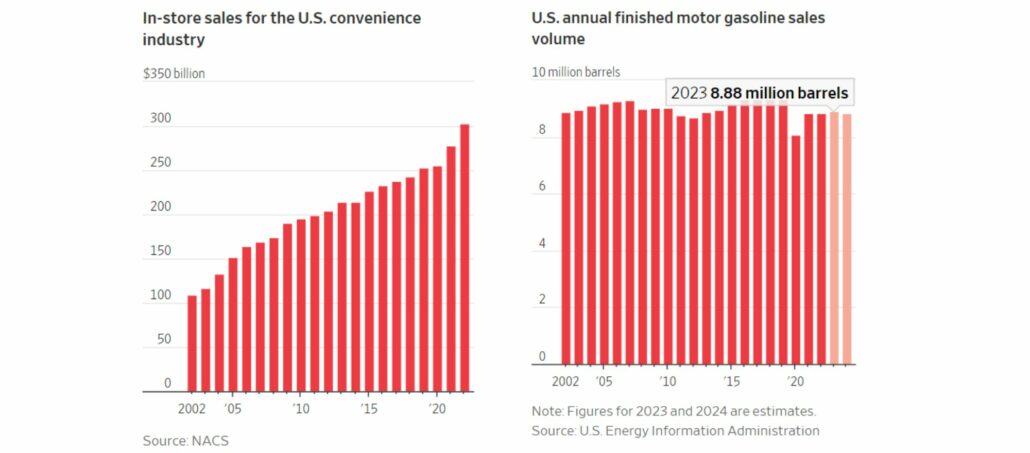

Expect to see more fresh food, and more big chains too. Food is an appetizing opportunity for convenience stores. On average, food-service sales accounted for about a quarter of in-store sales for convenience stores but well over a third of in-store gross profits, according to industry group NACS. At Casey’s, the gross margin on prepared food and beverages is about 60%, while its margin on fuel is closer to 10%. And as Casey’s Chief Executive Officer Darren Rebelez puts it: “You might fill up a tank once a week, but you eat three times a day.”

Convenience stores are all trying to grab a bigger piece of the food pie. Privately held Wawa launched a dinner menu in 2021 and has been expanding what’s on it, adding pizza in July. Casey’s added thin-crust pizzas to its menu earlier this year after realizing it was missing a piece of the customer base that only eats that variety. Thin crust now accounts for about 13% of Casey’s pizza sales.

Texas-based TXB Stores, formerly known as Kwik Chek, has been expanding its family take-home selection, both hot and cold. CEO Kevin Smartt said those offerings took off during the pandemic. These include a $19.99 meal of a dozen tamales, Spanish rice and refried beans. Many of these chains drive hype through limited-time menu items and have loyalty programs on their apps through which customers can order delivery.

Fuel and cigarettes historically were the mainstay of many convenience stores, but both are categories in decline. Gasoline sales volumes plummeted in 2020 and have flatlined below prepandemic levels due in part to ongoing improvements in fuel efficiency and rising electric vehicle sales. The Energy Information Administration is forecasting a slight drop in U.S. gasoline demand next year. But a shift to electric vehicles should go well with the food business if it means consumers spend longer stretches of time charging their vehicles. TXB, which has introduced EV charging stations in some stores, deliberately placed them near the outdoor dining facilities, according to Smartt.

7-Eleven’s Japanese owner Seven & i Holdings wants fresh food, proprietary beverages and private-brand products to account for 34% of its North American convenience stores’ revenue by 2025, up from about 24% in 2022. The company’s supplier of ready-to-eat food—Warabeya—has production plants in Texas and Virginia and plans to open more locations, including in Ohio. The chain also plans to open more 7-Eleven locations with Laredo Taco Company and Raise the Roost, the company’s own restaurant concepts.

Alimentation Couche-Tard, owner of Circle K, has set a target of increasing its food revenue by a compound annual growth rate of 10% over the next five years. Over the past few years, the Canadian company has introduced bean-to-cup coffee machines, or those that grind coffee every time a cup is poured, and more localized menu items.

Casey’s, which hired former IHOP executive Rebelez as its CEO in 2019, aims to expand its companywide earnings before interest, taxes, depreciation and amortization by a compound annual growth rate of 8% to 10% over the next three years. Accelerating the food business is part of that plan. Rebelez has introduced more restaurant-like processes to Casey’s, including prep shifts in the kitchen and a more disciplined menu-development process.

“Our [culinary development] process is up there with any restaurant chain,” Rebelez said.

Most convenience-store chains still have a fairly hands-off food strategy: It typically involves bringing in prepared chicken fingers, sandwiches and other menu items that are heated up in the store. This is the case for Circle K and 7-Eleven, though those chains also supplement their offers through adjacent restaurants. Selling freshly made food, as Casey’s, Wawa and TXB do, comes with potential for better loyalty and margins—but it isn’t easy: Kitchens are complicated and require investment. It is also a strategy that might work better for chains with some geographical density. Casey’s stores are concentrated in the Midwest, and the company self-distributes out of its three distribution centers in Iowa, Indiana and Missouri. Wawa also does self-distribution. TXB, which works with others, said its stores typically get about three to four food deliveries a week.

View article source here

Subscribe to our free mailing list and always be the first to receive the latest news and updates.