Sue Mitchell

October 15, 2018

AFR

Coles is shifting its focus from price to convenience as food prices start rising for the first time in 10 years and higher costs threaten to dent margins in the retailer’s first year as a standalone listed company.

New managing director Steven Cain says that while Coles will stay competitive on price his priorities include making life easier for customers by improving the retailer’s online business, which is approaching $1 billion in sales, and launching innovative new convenience store formats.

“We’re trying not to be too focused on beating the competitor, it’s more about doing a better job for customers and making life easier,” Mr Cain said on Monday after unveiling Coles’ strongest supermarket sales growth in almost three years.

“If we can deliver that better and faster then we should be able to grow faster going forward but we’re certainly not obsessed by doing a better job than competitor A, B or C,” he said.

“As far as prices are concerned we’ll be moving more towards a trusted value EDLP [every day low prices] platform over time, that’s going to be a lot to do with an improved own brand program.”

“We believe we are the best-value full-service supermarket out there and we want to maintain that as we invest in value over time [but] we’d prefer it’s engineered in rather than as a hit to margins,” he said. “That, and making life easier for customers will be an absolute focus of the business.”

Benign market

Mr Cain’s comments reinforced the growing view that the $100 billion food and grocery market will become more benign following the Coles demerger and price wars, which wiped 40 per cent off Woolworths food profits in 2016 and 2017 and almost 20 per cent off Coles earnings over the past two years will become less likely.

Fund managers say the $20 billion demerger is likely to lead to the most benign industry conditions in almost a decade because a standalone Coles will have less capacity to invest heavily in price while spending $1 billion automating its supply chain and distributing 80 per cent to 90 per cent of earnings in dividends.

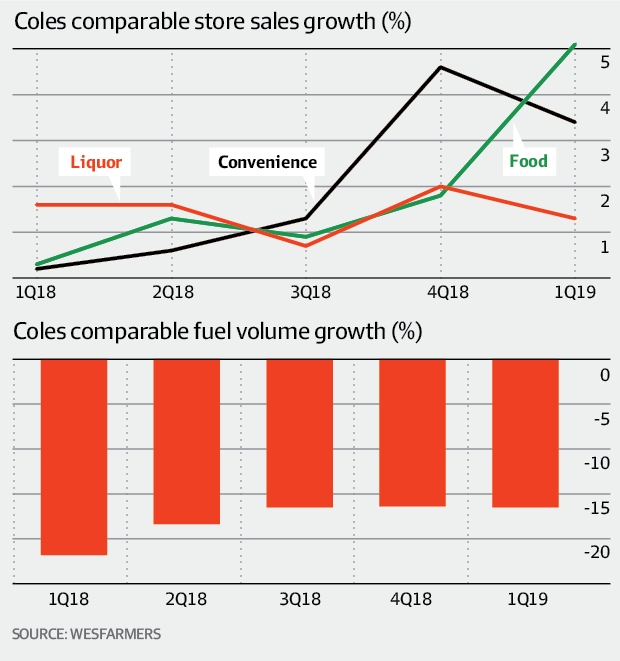

Coles same-store food sales rose a faster than expected 5.1 per cent in the September quarter, the strongest growth in almost three years, as consumers flocked to Coles supermarkets for miniature plastic groceries and free plastic bags.

However, Mr Cain confirmed analysts’ fears that the strong performance would not be repeated in the second quarter.

“We certainly won’t be repeating the same level of sales growth in Q2,” Mr Cain said.

“The most important part of Q2 is to come with Christmas, we think we have a much better year lined up re new products,” he said.

“We will be heading back more towards what we saw at the end of the fourth quarter versus Q1,” he said. “We expect to come from the 5 per cent we’ve seen this quarter more towards that 2 per cent Q4 number.”

Coles’ 5.1 per cent same-store food growth for the three months ending September beat analysts’ forecasts of between 4 per cent and 5 per cent and exceeded 4 per cent supermarket industry growth for the fiscal year to date, suggesting Coles clawed back lost market share – particularly in fresh foods – after underperforming for two years.

The gains were driven by strong growth in average basket size, units sold and transactions as Coles launched its successful Little Shop promotion, handed out free renewable plastic bags for 60 days after banning single-use bags, and improved out-of-stocks.

It was a significant improvement on the 1.8 per cent same-store food sales growth in the June quarter and 0.3 per cent growth in the year-ago period.

Online sales rose more than 30 per cent and Coles is on track to exceed $1 billion in online sales this year after cutting online prices to match prices in-store and rolling out click and collect to more than 1000 locations.

Easing deflation also helped, with food prices rising for the first time in ten years, up 0.6 per cent, compared with 0.6 per cent deflation in the June quarter and 2.3 per cent deflation in the September quarter 2018.

Higher grain prices and lower livestock supplies as a result of the drought pushed up prices for bread and meat and fresh produce costs rose after steep price falls last year,

Mr Cain said some of the factors pushing up food prices were “unique” but indicated that rising fuel costs would increase pressure on suppliers – and therefore retailers – to raise prices.

“It’s not something we’re actively driving but if some input costs go up that’s got to be reflected in retail prices,” he said.

Excluding fresh foods and tobacco, underlying prices fell 0.8 per cent as Coles continued to reduce prices for packaged groceries, shifting away from discounting towards lower everyday shelf prices.

Woolies to regain the lead

Analysts believe Coles’ same-store food sales grew faster than those at Woolworths for the first time in seven quarters. Woolworths is expected to reveal same-store food sales growth of about 1.5 per cent when it reports first quarter sales on November 1.

However, analysts say Coles’ outperformance is unlikely to last and Woolworths – which has fought back this quarter by ramping up discounting – will take the lead in the second or third quarter 2019.

Wesfarmers managing director Rob Scott said the sales result – the last before shareholders vote on the proposed $20 billion demerger of Coles on November 15 – was “very pleasing”.

Mr Scott and Mr Cain made no comment on margins or earnings but noted that Coles incurred additional costs employing more staff to help shoppers navigate the new plastic bag regime and boosting its investment in FlyBuys, while a new enterprise agreement which came into effect in April pushed up labour costs.

Citigroup analyst Bryan Raymond said rising costs could dampen Coles operating leverage, so earnings may grow at a slower rate than sales.

In liquor, same-store sales growth slowed to 1.3 per cent in the September quarter from 2.0 per cent in the June quarter and compared with 1.6 per cent in the year-ago period.

Total liquor sales, including hotels, rose 2.1 per cent to $744 million, with 21 stores refurbished, including the next evolution Liquorland format. Five store closures offset five new stores, taking the network to 900 liquor stores and 87 hotels.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.