Citi have recently published a report on the outlook for retail into FY22 and beyond that may be of interest. In the report, it is estimates the impacts of a resumption in travel, both domestic and international, stimulus withdrawal, shifting preference for working from home and a collection of other macroeconomic factors.

Key highlights are below:

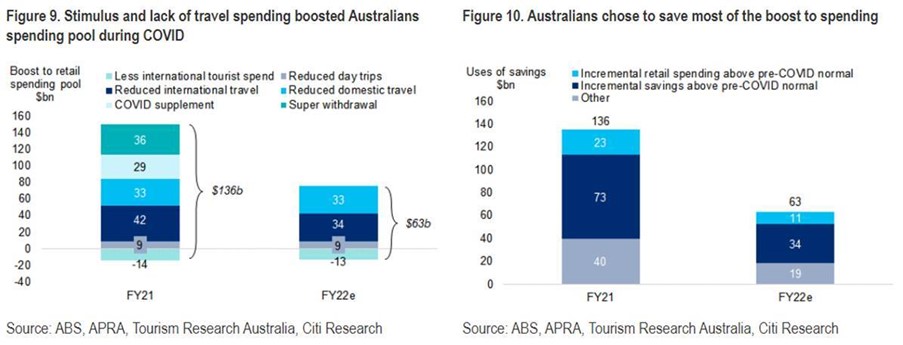

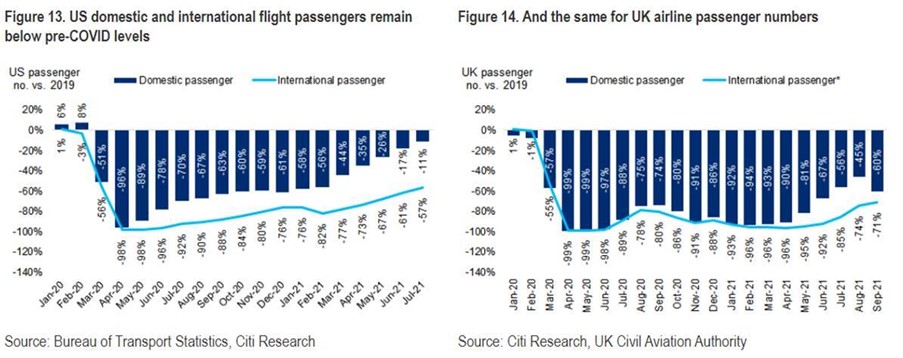

Retail spending facing a ~3% drag in FY22e — The resumption in tourism spending and withdrawal of government stimulus leads to a reduction in the spending pool available for retail. Within retail, we estimate a ~4% net detraction for at-home food and ~6% net detraction for Non-food retailing. However, a slow travel recovery, elevated household savings and buoyant housing market should provide some offset.

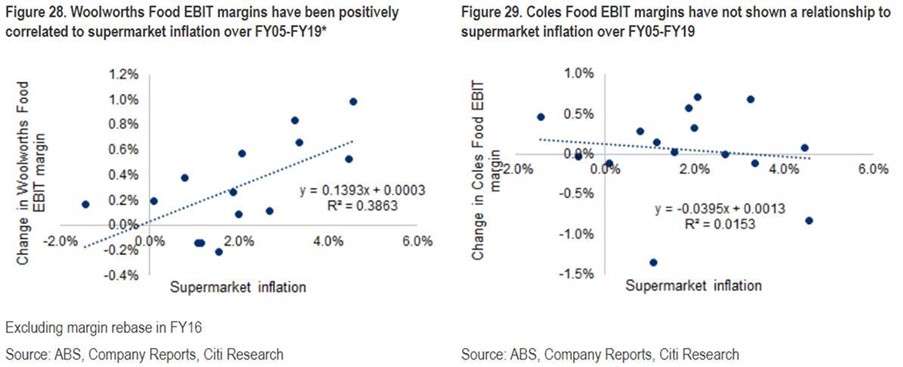

Higher food inflation to benefit supermarkets — We find that a 100bp increase in food inflation lifts supermarkets EBIT by up to 2-3%. This is despite assuming volume declines in response to higher inflation as was observed in recent years prior to the pandemic. International supply chain pressures in the discretionary categories are yet to impact retailers, likely because suppliers are offsetting higher supply chain costs with lower promotional spend as their categories continue to experience high demand. Some level of inflation will likely be welcomed by electrical retailers given some of their categories (eg IT, TVs etc) are usually in deflation.

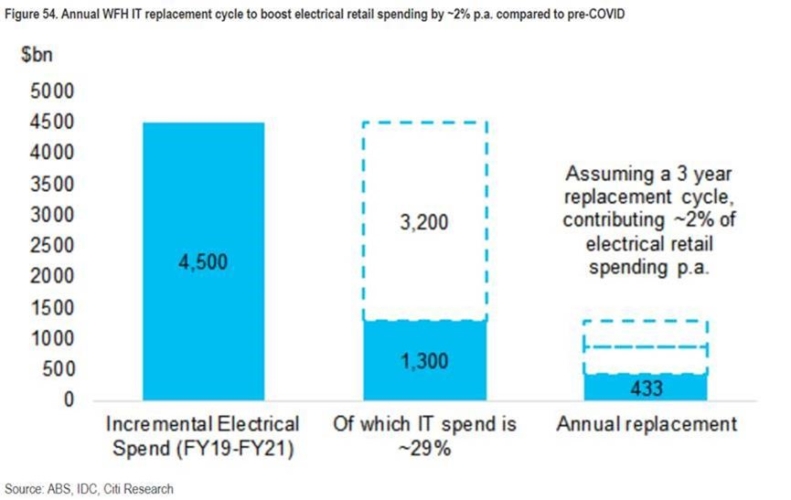

Work from home to lift longer-term structural demand — Surveys suggest a high proportion of people will be working from home at least a few days a week, particularly office workers. We estimate this will lift demand by ~3% in supermarkets and ~2% in electrical. The former will be driven by more time spent at home while the latter will be driven by an eventual replacement cycle of home office spend over FY20-FY21. Speaking more broadly, we believe sustained work from home points to an ongoing investment in the home. Furthermore, we believe there is little if any structural improvement factored into consensus forecasts or market pricing.

Online has made a step change — We expect non-food online penetration to continue to lag the UK and US given lower population density. However, once it finds a base as Australia begins ‘living with COVID’ we expect online sales will resume the prior growth rate of 10-15% pa. This would likely put non-food online penetration at ~30% by FY30. Similarly, we believe food online penetration will hit ~10% by FY30e.

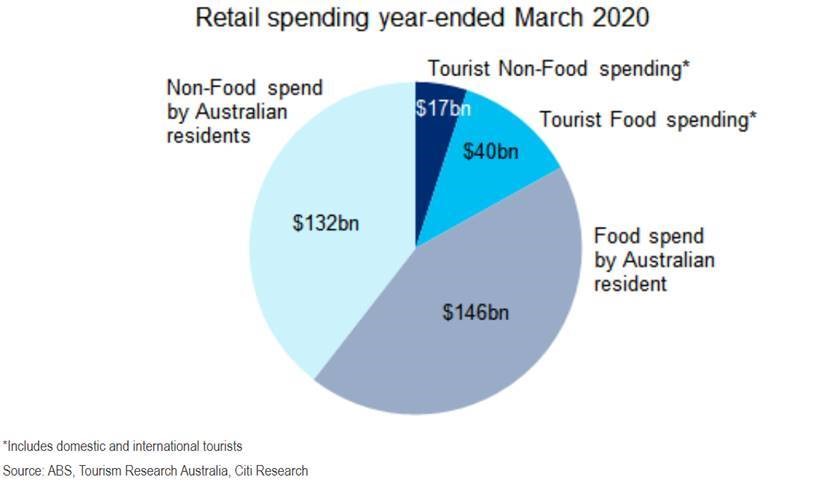

Australian retail spending by tourists

Subscribe to our free mailing list and always be the first to receive the latest news and updates.