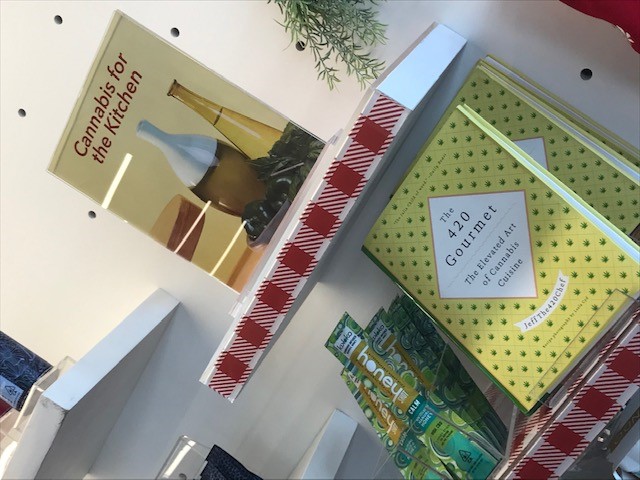

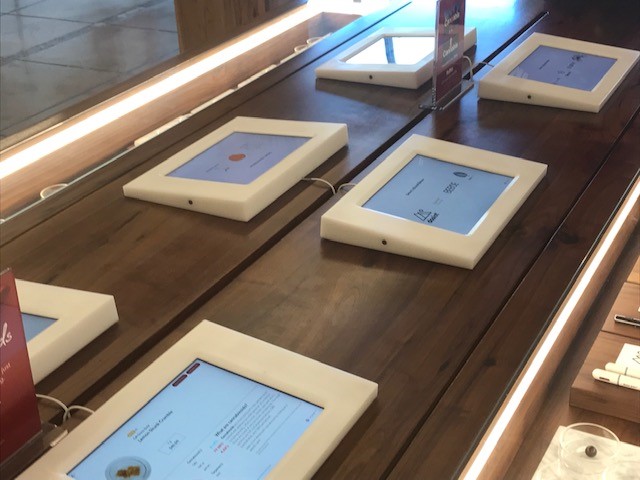

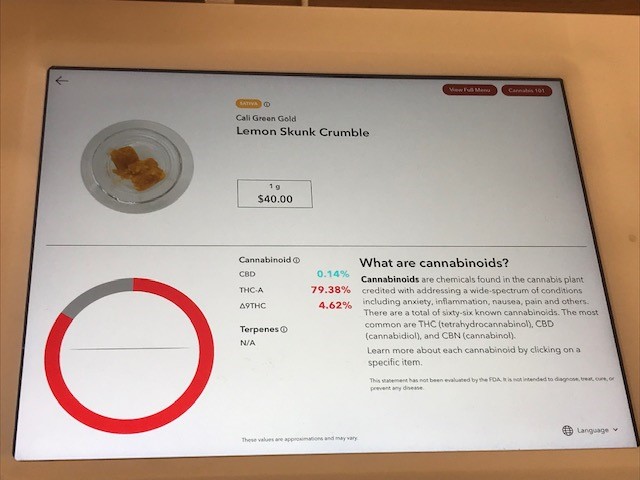

Interesting article follows from the AFR on medical cannabis. We visited a legal retail cannabis outlet in LA just last week as part of our overseas study tour. A very clean and professional operation. Customers are age verified before being allowed to enter and products are extremely well merchandise. Fixtures with up to date digital information have an ‘Apple’ store feel in terms of the clean uncluttered look and staff offer advice and service to customers. A few pic follow. Will we ever see such operations selling legal cannabis or a range of cannabis infused products to consumers in Australia?

Jeff Rogut

CEO

AACS

Cannabis stocks attract new investors

AFR

Yolanda Redrup

Oct 12, 2019

A tough regulatory environment has proved a buzzkill for the euphoria that drove listed medical cannabis stocks sky-high this year, but beaten-up valuations are attracting new investors with an eye on long-term growth in the treatment of a range of medical conditions.

Activist investor Merchant Group has emerged as a bargain hunter in the sector, buying an 11.4 per cent stake in ASX-listed AusCann for more than $5.4 million, as demand for the product continues to rise.

Merchant Group managing director Andrew Chapman said the sector had been on a downer because earlier hype had given way to the reality of the challenges of operating in a highly regulated industry.

“There was a lot of hype in the industry and I believe the regulatory environment wasn’t really ready for the patient movement that has clearly started or [for] the amount of investment money chasing returns,” he said.

“The current state of the market will be patient-driven, which I think is different from hype.”

The tightly regulated sector had been slow to take off locally, as every patient must be registered to access the special access scheme and doctors must be authorised prescribers. However, momentum is expected to pick up as more people are granted access.

Merchant Group bought the shares in AusCann from its major shareholder and the largest publicly listed company in the space, Canopy Group Corporation.

It is the latest major medical cannabis investment for Mr Chapman, who previously bought up a significant position in now defunct stock 1-Page. He then orchestrated a board takeover, shut down the business and brought about a reverse takeover in which the 1-Page shell became the owner of German medical cannabis company HAPA Pharm.

The group had also invested previously in Cannpal Animal Therapeutics and Zelda Therapeutics.

Mr Chapman told The Australian Financial Review he wanted to use his experience with HAPA to be a “supportive shareholder” of AusCann.

“We have extensive experience and contacts in the space both domestically and internationally and feel that we can assist in fast-tracking commercial outcomes in the near term,” he said.

“We will look to maintain a close working relationship with Canopy Growth Corporation, as AusCann reshapes itself to regain its leadership position in the Australian medical cannabis sector.”

Mr Chapman has a history of acquiring significant positions in companies that he believes need help to be turned around and then shaking up the board and management teams of the companies.

This is the second time he has been a part owner of AusCann, having owned shares before its ASX listing in early 2017.

By late September, more than 17,300 people had been granted access under the special access scheme and monthly approvals had leapt from 331 in October 2018 to almost 3000.

A report this year from Cannvalate said Australia had the fourth-largest cannabis market globally and more than 100,000 people had been turning to “black market” medical cannabis.

Australia has at least 20 listed cannabis companies; the largest by market capitalisation is Elixinol Global, which is valued at $284 million, but as recently as July it was worth more than double that.

Other companies in the sector have also suffered losses since mid-year: Althea Group is down 47 per cent, while Cann Group is down 34.6 per cent.

AusCann, which is led by former Teva Pharmaceuticals executive Ido Kanyon, is trading at its lowest point in the last year at just 32.5¢, having sold for as much as 96¢ per share a year ago. It has a market capitalisation of $103 million.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.