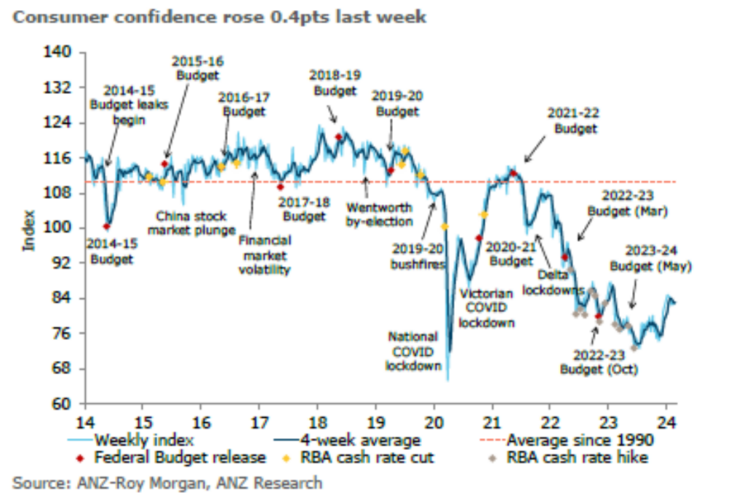

ANZ-Roy Morgan Consumer Confidence was virtually unchanged at 83.2 this week. The index has now spent a record 56 straight weeks below the mark of 85. Consumer Confidence is now 3.2 points above the same week a year ago, February 20-26, 2023 (80.0), but 0.4 points below the 2024 weekly average of 83.6.

There were mixed results around the States with Consumer Confidence up in Victoria and Western Australia, down in Queensland and South Australia and virtually unchanged in New South Wales.

Current financial conditions

- Now a fifth of Australians, 20% (unchanged) say their families are ‘better off’ financially than this time last year compared to 53% (up 3ppts) that say their families are ‘worse off’.

Future financial conditions

- Views on personal finances over the next year are evenly balanced with a third of Australians, 33% (unchanged), expecting their family to be ‘better off’ financially this time next year while almost as many, 32% (down 1ppt), expect to be ‘worse off’.

Short-term economic confidence

- Just one-in-ten Australians, 10% (unchanged) expect ‘good times’ for the Australian economy over the next twelve months compared to just over a quarter, 29% (down 2ppts), that expect ‘bad times’.

Medium-term economic confidence

- Net sentiment regarding the Australian economy in the longer term improved slightly this week with 13% (unchanged) of Australians expecting ‘good times’ for the economy over the next five years compared to just under a fifth, 18% (down 3ppts), expecting ‘bad times’.

Time to buy a major household item

- Buying intentions were slightly down this week with 20% (down 3ppts) of Australians saying now is a ‘good time to buy’ major household items while 48% (down 2ppts), say now is a ‘bad time to buy’.

ANZ Senior Economist, Adelaide Timbrell, commented:

ANZ-Roy Morgan Australian Consumer Confidence has hovered around a tight range of 82.8–84.8 since the beginning of the year.

While this is higher than from mid-February to December 2023, the trend over the last eight weeks has been broadly sideways.

We expect a material increase in confidence may be triggered by improving household finances, which we expect to see as wages continue to outpace inflation, as they did in Q4, and then further once tax cuts are implemented.

There is some optimism about ‘future financial conditions,’ which remained above the neutral 100-level last week.

View article source here.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.