With 1.3 million adults using vapes, senior government figures and officials are assessing the tax and health upsides of regulating vaping nicotine products in tandem with state and territory governments.

A regulatory crackdown on vaping products by the Albanese government would raise about $1.7bn over four years in taxes and import tariffs, providing new revenue streams to combat structural spending blowouts and indexation hikes to pension and welfare payments.

With 1.3 million adults using vapes, The Australian understands senior government figures and officials are assessing the tax and health upsides of regulating vaping nicotine products in tandem with state and territory governments.

Health Minister Mark Butler and the Therapeutic Goods Administration have flagged a crackdown on the vaping blackmarket and committed to reclaiming Australia’s position as a “world leader on tobacco control”, with senior government sources declaring “everything is on the table”.

Drawing on lessons of the Gillard government’s 2012 plain packaging laws, a range of options are under active consideration, including labelling, excise, banning flavoured vapes and tightening border controls. A decision on a national regulatory framework, in which states and territories would be required to enforce new vaping rules is expected after the March 25 NSW election.

Amid a concerning number of school-aged children accessing vapes online, there is growing cross-party support to follow other Western nations, including France, Britain and New Zealand, in regulating and licensing the sale of vaping products.

Queensland Premier Annastacia Palaszczuk this week ordered a parliamentary inquiry into the availability and prevalence of vaping devices, raising concerns that vaping could be a “stepping stone to smoking” for younger Australians.

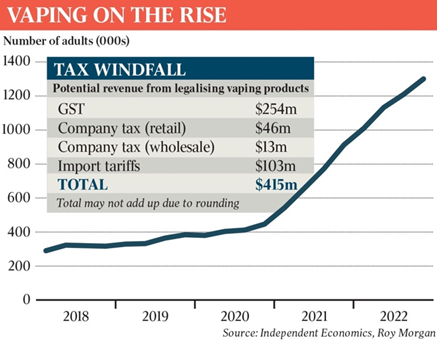

A new report by London-based Independent Economics – commissioned by British American Tobacco – estimates that regulating vaping would deliver a yearly budget windfall of about $415m, including $254m in GST, $59m in retail and wholesale company tax revenue and $103m in import tariffs.

Roy Morgan survey data, commissioned by the report authors, reveals the number of adult vapers in Australia has nearly tripled in two years to 1.3 million. The survey shows that 73 per cent of Australians support vaping products being sold as a regulated adult consumer product.

The 51-page report said estimated tobacco revenue in 2022-23 decreased from $12.8bn in the March 2022 budget to $12.4bn in the October budget and was projected to flatline in coming years as more Australians shifted from cigarettes to vaping.

“Forward revenue forecasts in the budget papers are that tobacco taxation revenue will increase from the 2021-22 actual of $12.6bn to just $13.3bn in 2025-26,” the report said. “In real terms, (tobacco tax) revenues grew over the decade 2012 to 2022 by 3.3 per cent per year on average.

“However, in the period 2020 to 2022, combined cigarette and (roll-your-own) tobacco excise receipts fell by 8 per cent per year on average (falling by 3.5 per cent in real terms between 2020 and 2021, and by more than 12 per cent in real terms in 2022).”

The Roy Morgan survey says if tobacco excise were to be increased further, “some 14 per cent of current consumers of legal tobacco products would substitute illicit tobacco for them; and a further 9 per cent would substitute vaping products”.

“This would represent a potential loss of government tax receipts of $2.9bn as consumers moved from the legal market to the blackmarkets.”

About 63 per cent of Australian believe the prescription model introduced by the Morrison government in 2020 has “not worked well to stop young people from accessing vaping products”.

Only 8 per cent of vapers are believed to have a current GP prescription.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.