Treasury warned Jim Chalmers the government’s 2023 decision to ramp up tobacco excise would fuel trade in the black market, and that the high cost of legally purchased cigarettes was one of the factors driving a decline in tax revenue.

Dr Chalmers announced in May 2023 that the federal government would increase excises by a further 5 per cent per year on top of the normal indexation for three years.

This pushed the cost of a pack of 25 cigarettes to about $50 dollars – $34 of which goes to the government.

With tobacco excise rates up 282 per cent since 2013, Treasury also admitted the high cost of legally purchased cigarettes was driving a fall in tax revenue.

Treasury advice prepared alongside the measure warned the tax rise could have perverse outcomes, despite smoking remaining the leading cause of preventable death in Australia, according to documents released under freedom of information laws.

“Further increases to the tobacco excise and excise-equivalent customs duty will strengthen incentives to trade in illicit tobacco, both counterfeit cigarettes and loose-leaf tobacco, as well as substitution into electronic cigarettes (vapes) containing nicotine, which are substantially cheaper than even illicit cigarettes,” Treasury said.

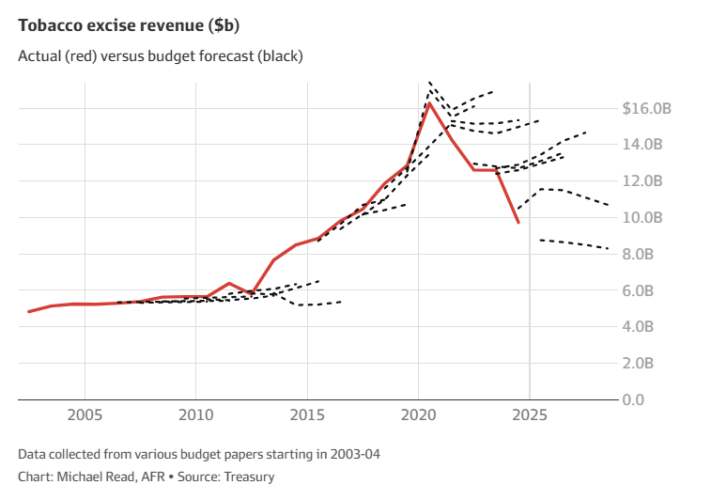

The warning has been borne out in falling government revenue.

Tobacco excise contributed just $9.7 billion to federal coffers last financial year, a 40 per cent fall from the record $16.3 billion haul in 2019-20 and the lowest take since 2014-15.

Successive Labor and Coalition governments have collectively increased the tobacco excise by 282 per cent since 2013.

Economists say the increases have become counterproductive and pushed consumers to the black market, rather than deterring them from smoking.

The growth in illegal sales has also come at the expense of tax revenue.

The lure of handsome profits has fuelled a growing industry of corner stores selling illegal tobacco and a run of firebombings, as gangs battle over control of the fast-growing market.

The surge in crime has been most acute in Melbourne, with more than 120 arson attacks since March 2023 linked to a turf war over illicit tobacco.

In its advice, Treasury also flagged that tobacco tax rises “can disproportionately impact socially disadvantaged groups who are more likely to be regular smokers”, including Indigenous Australians, poor people, individuals with mental health conditions, and people living in the regions.

“However, socially disadvantaged groups are also those that are more likely to quit smoking in response to increases in prices,” Treasury said in its advice.

Treasury has consistently overestimated how much tobacco tax the federal government will receive since 2019, and the mid-year budget update in December revealed yet another downgrade in projected collections, this time to the tune of $10.7 billion over four years.

Dr Chalmers did not respond to a request for comment.

Illicit ciggies boom

A Treasury briefing prepared in the lead-up to the mid-year budget update said a reason for the downgrade was “increased substitution to the illicit market, which is partly driven by higher excise rates”.

Treasury said there was now a large difference in prices between legal and illicit products, with a pack of 20 cigarettes costing about $15 on the black market.

Other factors cited by Treasury for the decline in revenue included the increased substitution to vaping, higher rates of quitting, and a reduction in discretionary spending caused by cost of living pressures.

Treasury now projects excise revenue to fall to a decade-low of $8.8 billion in 2024-25.

Dr Chalmers has previously rejected suggestions the tobacco excise rate should be lowered, and instead focused on the “compliance challenge” caused by the growing illegal market.

“The good reason for [the decline in tobacco revenue] is that is more and more people are giving it away.

That’s a good thing,” he said in December.

“But we’re also aware we’ve got to make sure that we keep up our efforts on compliance.

There is an issue with compliance and with illegal tobacco. We’re aware of that.”

A separate Treasury document, dated October 2024, said “reducing the affordability of tobacco products through taxation increases remains the most effective measure in reducing smoking rates”.

The World Health Organisation recommends tobacco taxes should account for 70 per cent of the retail price of tobacco products.

The combination of rising tobacco excises and public health campaigns has caused the proportion of adults who are daily smokers to halve from 22.4 per cent in 2001 to 10.6 per cent in 2022, according to the Australian Bureau of Statistics.

$2.7b in lost revenue

The Australian Taxation Office, which works alongside the Australian Border Force on enforcement, said the illicit tobacco market was increasing despite the decline in smoking rates.

The Tax Office estimates a record 18 per cent of all tobacco for sale in 2022-23 was illicit, and would have earned the federal government an extra $2.7 billion if it was instead sold legally.

Vapes, e-cigarettes and other products containing nicotine are not subject to excise duty.

The Coalition has promised to commit $250 million to combat illegal tobacco, setting up a taskforce to be led by the Australian Federal Police and the Australian Border Force.

Significant excise rises by successive federal governments mean the tobacco excise per cigarette stick has increased to $1.37 from 36¢ in August 2013 – a 282 per cent increase.

Wages, by contrast, have increased by just 31 per cent over that period.

The Rudd government announced in August 2013 that the federal government would increase the tobacco excise by 12.5 per cent per year for four years on top of the ordinary indexation that occurs.

The policy was framed as a health measure, but had the added benefit for the government of raising a projected $5.3 billion over four years.

While the final hike was meant to take place in July 2016, then treasurer Scott Morrison announced in May 2016 the jumbo excise rises would be extended for another four years to 2020, raising an extra $4.7 billion.

View article source here.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.