Card fees hit record levels, but industry says they are driving costs down.

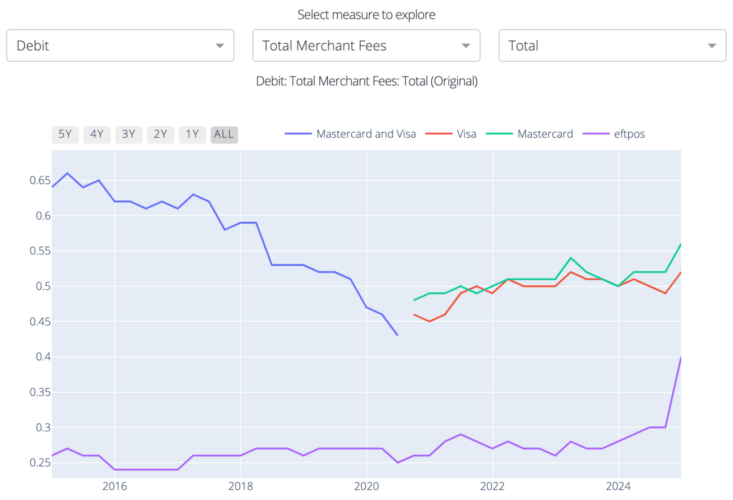

Official data on the average cost of merchant fees on debit and credit card transactions just went through the roof, directly contradicting recent industry claims that card fees are getting cheaper for small businesses.

In fact, the new Reserve Bank of Australia data for debit card fees shows eftpos fees jumped 33.3% on last quarter.

Visa and Mastercard jumped too.

Visa was up 6.1% and Mastercard was up 7.7%.

The new data is based on expanded coverage to directly include larger payment facilitators and additional acquirers most likely to be international players and fintechs, many of whom have recently increased market share and often charge high blended rates that combine debit and credit card fees.

The fee surge comes in the midst of the RBA’s Review of Merchant Card Payment Costs and Surcharging, which is considering “whether regulatory settings could be adjusted to put further downward pressure on merchant card payment costs and whether the RBA’s surcharging framework remains fit for purpose”.

The RBA is particularly concerned about rising fees for debit cards which millions of Australians use as a replacement for cash and should be low cost.

Chart via Qi’s Payments Dashboard.

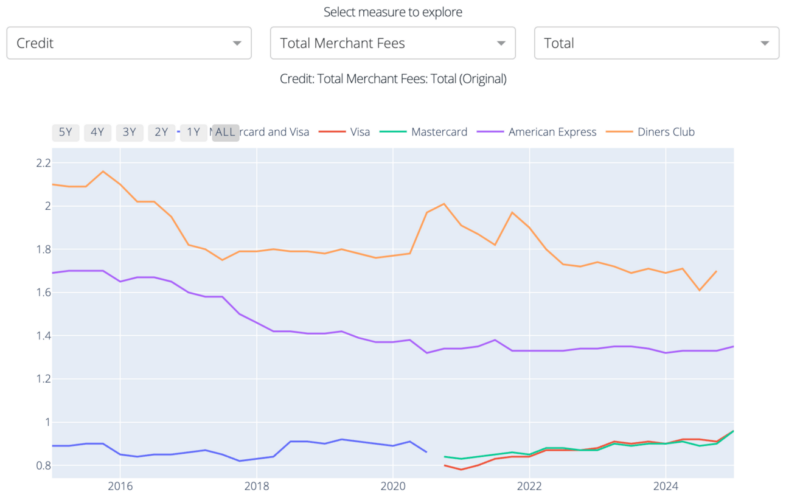

It wasn’t just Debit card Fees that spiked. Credit card fees jumped as well.

Visa was up 5.5% to 0.96%, Mastercard was up 6.7% to exactly the same number total merchant fee.

Card purchases ending 2024 as a $1.04 trillion market, with both debit and credit at record highs.

Overall Debit Card growth actually rose to end the year, up to 8.1% growth over the course of 2024 to $609 billion in annual purchases.

That’s of course 0.96% on average for Visa and Mastercard, the highest it has ever been, although the new reporting entities mean that it isn’t directly comparable with previous quarters.

But the 5 year trend was already up (see the green and red lines above).

FinTech Australia CEO Rehan D’Almeida recently said many fintechs were driving down the costs associated with our “intricate card payments system”.

“The fintech industry has always aspired towards the financial betterment of all Australians.

Compared to the UK, New Zealand and US, Australia has some of the lowest costs per transaction.

Even with this, average merchant services fees fell from 0.83% in 2015 to 0.65% in 2024 largely due to competition driven by the fintech sector behind the scenes.”

The Australian Banking Association has also claimed that there has been a significant drop in merchant fees.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.