A new State of Small Business Data Report, released today by Square and The Council of Small Business Organisations of Australia (COSBOA), shows Australian SMBs and micro businesses struggling to maintain resilience in the face of tough economic headwinds, with small business owners looking to policymakers and government for more support.

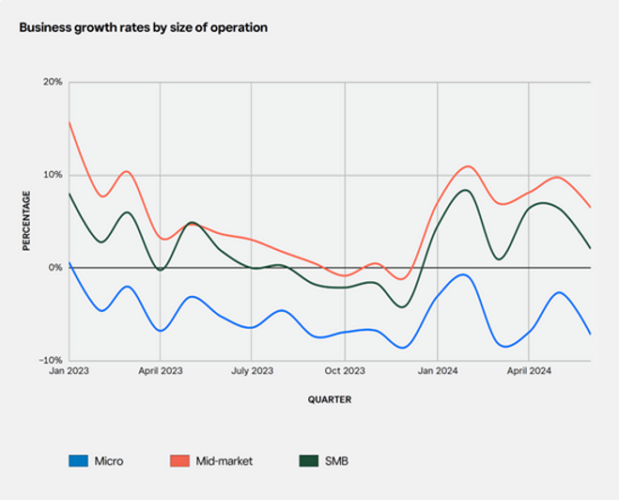

Data from millions of transactions processed on Square between January 2023 and June 2024 reveals a two-speed economy in Australia, with local micro and small businesses recovering slower than their mid-market peers in the first half of 2024 (compared to the same period in 2023), and businesses growing at different rates depending on their location, sector, and size.

For example, mid-market businesses dipped slightly into negative territory in the July and October 2023 (YoY) quarters before recovering to positive growth, whereas SMBs navigated a longer and deeper period of negative growth.

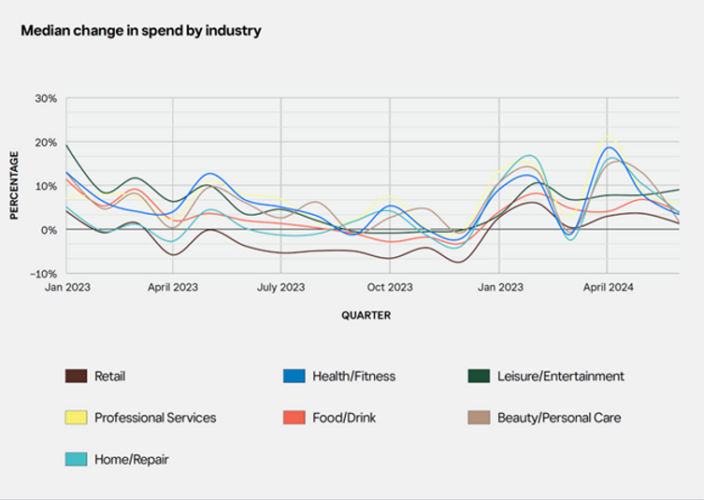

Square data also shows spending across all sectors fluctuating in line with shifting consumer behaviours.

Spending through the December-January holiday period pushed small retailers into positive growth after spending the majority of 2023 in negative territory.

Health care and fitness exhibited steadier spending patterns than industries like beauty and professional services, which showed marked variability in spending through the period.

Interestingly, hospitality businesses using Square saw a steady increase in spending, peaking in the April 2024 quarter, despite well-publicised weakness in the sector more broadly (graph below).

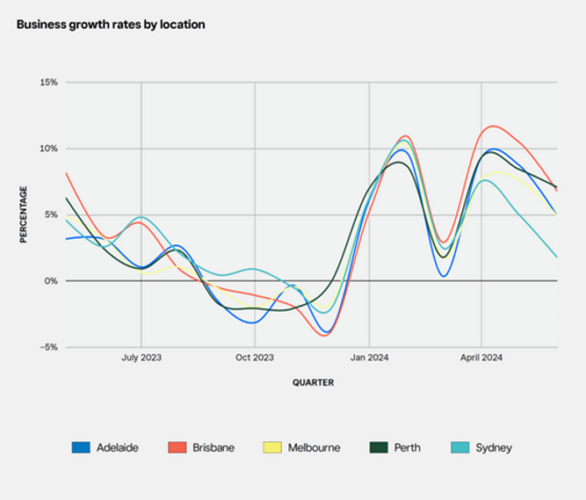

Businesses based in Brisbane experienced the strongest growth in the period from late January to 1 May (10.49% YoY) compared to Sydney businesses which saw the weakest growth (5.03% YoY).

Square data shows businesses in certain locations, including Brisbane, Adelaide and Perth, performed better than those in Australia’s biggest cities, Sydney and Melbourne, in the traditionally slower economic period following Christmas and New Year (graph below).

Small business optimism hangs in the balance

Conditions are tough out there for Australia’s small businesses, as highlighted by a survey of small business owners across the country which showed roughly half (49%) are feeling less optimistic about the Australian economy in the next 12 months.

Despite that, 53% of small business owners say they are just as optimistic about their operations today as they were 12 months ago. Just 1-in-5 (22%) say they are more optimistic and a quarter (25%) say they are less optimistic.

Small businesses continue to feel the pinch of inflation, with owners noting that many operational costs are weighing more heavily on them today than they were 12 months ago.

An overwhelming majority of 73% of small business owners say they are feeling more pressure today over rising utilities bills.

Around two-thirds (65%) agree that increases in their supplier costs are placing a heavier burden on their operations today than a year ago, while 63% are feeling the pinch due to rising insurance premiums.

Government levies, like rates and licences, are also an area of concern, with 62% in agreement.

Occupational costs including rent and mortgages are a greater burden today than they were 12 months ago for half (50%) of small business owners, while labour costs and servicing existing loans are straining the capacity of 45% and 42% of surveyed small businesses respectively.

In order to cope with these increased cost pressures, over the last 12 months, just under half (46%) of small business owners have increased prices, and 1-in-5 have streamlined operational processes and changed their approach to marketing or social media.

Looking to government for support

Small business owners outlined the areas where government policy could make running their businesses easier.

Just under half (46%) of small business owners are keen to see certainty around the future of the Instant Asset Write Off; 42% would like more incentives to encourage technology adoption to support their efforts in areas including artificial intelligence, eInvoicing, digital payments and cyber security; and 44% are looking for greater access to low-interest loans and grants which support sustainability and innovation.

Marco Lamantia, Executive Director, Square Australia, quote: “There’s no doubt that small businesses have been navigating an incredibly difficult period, but what cannot be underestimated is their adaptability and resilience in the face of adversity, and utilising technology to overcome economic hurdles.

This is reflected in part by findings from the report which show that hospitality businesses using Square technology experienced a steady increase in spending, which slightly goes against recent discourse that hospitality businesses are struggling across the board and one in 11 hospitality businesses (9.1%) may fail over the coming year.”

Luke Achterstraat, Chief Executive Officer, COSBOA, quote: “Every small business owner faces a unique situation – a distinct set of challenges and opportunities.

This latest report from COSBOA and Square highlights this reality.

‘Small business’ isn’t one homogenous mass and this report underlines the need for policy solutions to be appropriately nuanced, tailored and targeted if small businesses are going to feel a positive impact.

The individual experiences and voices of small businesses should also be routinely sought out, heard in policy discussions, and reflected in initiatives coming from all levels of government.

Australia’s macroeconomic environment this year has been tough for small businesses, so it is squarely in the national interest to ensure that they don’t just survive but thrive.

When small businesses succeed, the entire Australian economy benefits.”

Subscribe to our free mailing list and always be the first to receive the latest news and updates.