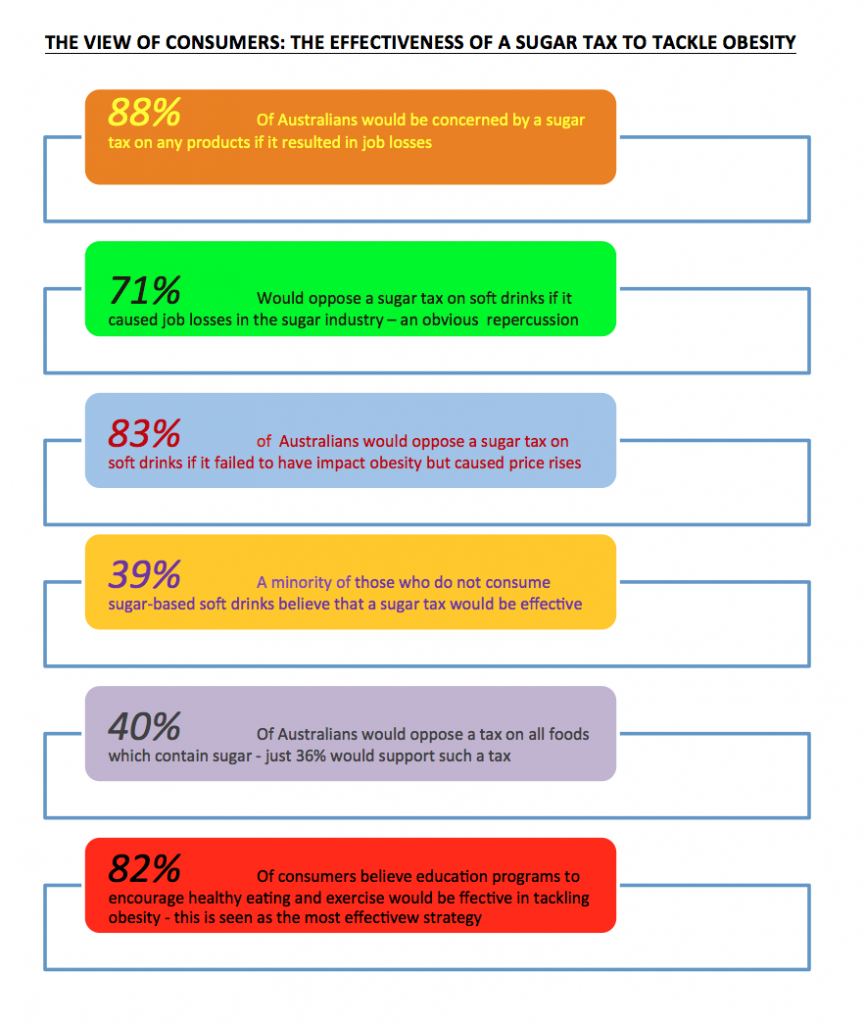

19TH September 2017: Research conducted late 2016 from the Australasian Association of Convenience Stores (AACS) shows the majority of Australians believe a sugar tax would be ineffective in the fight against obesity, with most opposed to such a tax on the basis it would increase cost of living pressure, threaten businesses and jobs, and because there are better ways to tackle obesity.

According to the AACS research, a major reason for consumers’ opposition to a sugar tax is that it would be ineffective yet cost more, as has been the case with other products subjected to reactionary taxation.

Consumers aren’t the only ones who question whether the tax will make any difference to obesity levels. Even Stephen Duckett, the principal author of a report prepared for the Grattan Institute, concedes that should the tax cut soft drink consumption, there’s no evidence that it would necessarily reduce obesity too.

Other concerns surrounding the negative consequences of a sugar tax is the potential impact on job losses, and the threats to food manufacturers, the sugar industry and convenience store trade.

The AACS survey, involving 4,000 voters aged 18 years plus from around Australia, shows consumers believe the most effective strategy to reduce obesity is to ban advertising of high calorie foods during children’s TV programs, while the least effective strategy would be to impose a sugar tax.

The main objective of the survey was to measure public attitudes towards a sugar tax broadly, as well as on soft drinks specifically, in terms of the best ways to address obesity in Australia.

“These results comprehensively demonstrate that Australians don’t believe that introducing a sugar tax will impact consumer behaviour, nor health outcomes. Most are opposed to a sugar tax because it will pressure their budgets, and threaten jobs and industries,” AACS CEO Jeff Rogut said.

The AACS has repeatedly reinforced the financial burden that emotionally charged legislative responses can place on businesses and consumers. Discriminatory excise applied to select products merely drives up prices for consumers.

The research shows voters agree.

“This research ultimately shows that voters don’t believe a sugar tax will work and that there are other more effective strategies that Government could and should adopt to tackle obesity,” Mr Rogut said.

“It can be seen like any other tax: a revenue raiser, pure and simple.

“Taxing certain products invariably hits small businesses much harder than it does larger corporations. Small businesses like convenience stores are much less able to absorb the additional costs than the major supermarkets, but there are also negative impacts for manufacturers as well as farmers.

“The additional price pressure will almost certainly result in reduced sales for convenience stores as consumers shift their purchasing habits to making bulk purchases from the major supermarkets.”

Mr Rogut said regular tobacco excise increases provide a clear precedent for this shift in consumer behaviour. Sales growth of cheaper tobacco products coincide with every excise increase.

“The economic ramifications for manufacturers, suppliers and retailers of a sugar tax would be immense, yet the potential for it to achieve improved health outcomes is unknown. It’s too big an economic risk for Government to take in the context of the challenges already faced by retailers and manufacturers,” he said.

The AACS research shows Greens voters are relatively more inclined to believe that a sugar tax would be effective in tackling obesity (36% of Greens voters believe it would be effective), while Coalition voters (27%), Labor voters (26%) and Independent voters (25%) all rate the sugar tax idea at about the same level.

“With such significant opposition to a sugar tax across party lines, it’s clear any proposal along these lines would be politically divisive,” Mr Rogut said.

The AACS supports the right for Australians to exercise their right to choose to consume legal products, to exercise their own discretion and enjoy the freedoms of being Australian.

“Applying tax to certain products because they have an emotional association to obesity in the minds of some health groups is not only flawed, it’s short-sighted, lazy and even discriminatory against those who choose to consume these products,” Mr Rogut said.

“And as we’ve seen time and time again, discriminatory taxes don’t work. This research shows Australians recognise this. Now politicians have the view of the electorate as well, instead of just those of the extremely well-funded health lobby,” he added.

Mr Rogut pointed to the example of Denmark where, in 2011, the Government introduced a “fat tax” in an attempt to limit the population’s intake of fatty foods. Just 12 months later, the Government announced it would scrap the tax and cancel its plans to introduce a sugar tax.

According to the Danish tax ministry, this was because of increased prices for consumers, increased administrative costs which created a bureaucratic nightmare for producers and retailers, and because it put jobs at risk. All the while, Danes simply travelled across the border to make purchases.

Mr Rogut emphasised that some convenience retailers and suppliers have already taken action to improve the health profile of their products and others continue to develop healthier alternatives.

“These efforts to innovate should be supported, not hindered with the imposition of additional costs in the form of a sugar tax or other excises,” Mr Rogut said.

As the Prime minister said on TV and radio today: ” But Mr Turnbull says while obesity is a major challenge, a tax on soft drinks is not the solution.

“I think we have enough taxes and there are enough imposts on us all when we go to the supermarket and we go shopping,” he told the Nine Network on Tuesday.

“The other thing is too where do you draw the line? There is a lot of sugar in a bottle of orange juice, are you going to put a tax on that?”

“Labelling is very important, health messages through the media, … but also exercise. Get up and walk,” he said.

*** A summary of the AACS research follows ***

Subscribe to our free mailing list and always be the first to receive the latest news and updates.